THE FIRST THREE YEARS

Assessing the impact of Ontario’s licensing model

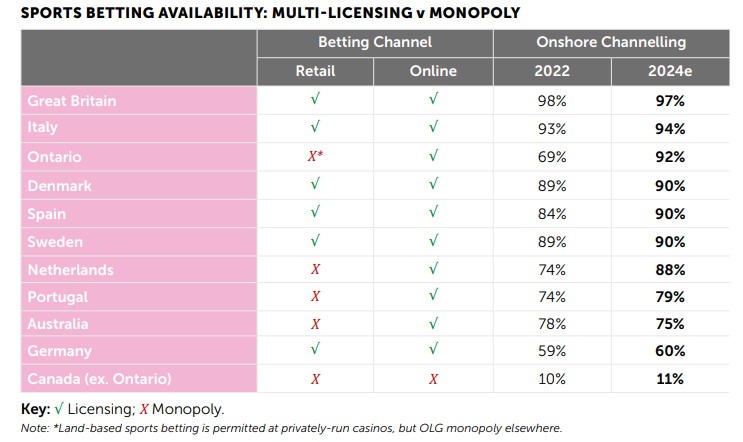

In 2022, Ontario broke away from Canada’s traditional monopoly model for sports betting operator licensing, part of a wider regulatory trend instigated by the growth of online sports betting. In this article we review the success of that decision, using data from IBIA’s “The Availability of Sports Betting Product: An Economic and Integrity Analysis” for both Ontario and Canada as whole.

Licensing versus Monopoly Models

The regulatory and licensing framework provides the core foundation of any policy on the availability of betting services, both land-based and online. There are a variety of approaches adopted globally, but the four main regulatory models in operation are:

prohibition; monopoly/single license; a limited number of licenses; and an unlimited number of licenses. A single model may be applied universally across all betting services in a jurisdiction or one may see differing approaches applied to land-based and online businesses. In some countries, the position can become more complex with variations across different regions.

The perceived success of the model employed is open to different interpretations, based on the focus of the policy in operation. However, if the fundamental policy approach is to have control and oversight of the market, then the compliance of consumers (onshore channeling) of that policy can be considered a core indicator of success. This section considers the general availability of sports betting, notably online, and the resulting impact on onshore channelization, with the following sections focusing on the linked issue of the product offering.

The Impact of Online Sports Betting on Regulatory Approaches

Many countries have historically regulated the supply of betting services through a monopoly operator, often state-owned, and through land-based facilities. In some cases, the framework has provided different bodies with sole control of specific forms, such as betting on racing (on and off racetracks) and, separately, betting on other sports. Choice and competition are consequently restricted, as are related product attractiveness and innovation. With the advent of online betting, the predominantly land-based supply has been challenged by the ease of consumer access to offshore, online betting services, with the latter often providing a modern, broader product catalogue.

The consumer migration to those offshore services has resulted in jurisdictions losing oversight and control of consumer gambling activity, along with taxable revenues. This has caused many policymakers around the world to reconsider their regulatory approach to the availability of sports betting services, notably online. It has also led to the wider questioning of why a jurisdiction would be directly involved in the ownership and management of a service that can be conducted via licensed and regulated private entities.

It has resulted in numerous jurisdictions introducing licensing systems for private operators to offer online sports betting, although land-based monopolies persist in some areas. That includes countries such as Portugal, Spain, Sweden, Germany, Ontario and the Netherlands. Others such as Peru, some provinces in Argentina, and over 30 U.S. states have also recently adopted online, sports betting-licensing arrangements. Chile is in the process of introducing such provisions and Kenya is advancing legislative measures to introduce specific online licensing.

Some jurisdictions have nevertheless sought to maintain the land-based and online monopoly supply of betting services, either nationally or at state level. Norway and Finland are two of the few remaining examples left in Europe. However, Finland has announced that it intends to introduce an online gambling licensing system by 2026.

The Impact of Ontario’s New Approach

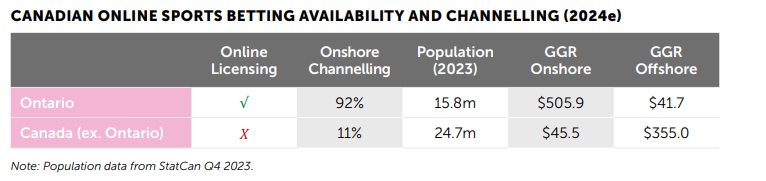

Canada is a useful case study. Many of its provinces and territories legislate and control land-based and online gambling, primarily through monopoly operators. Ontario, Canada’s largest province by size of population, broke away from that model and introduced a licensing system that has been operational since April 2022.

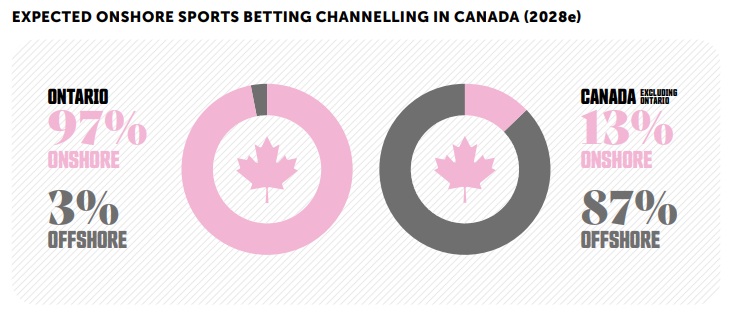

Ontario immediately overtook Germany’s onshore channelization and is expected to reach 92 percent in 2024, overtaking Australia. Ontario is forecast to reach 97 percent onshore channelling by 2028. This is all the more impressive when that onshore growth is in part a result of drawing consumers away from a well-established offshore market. By contrast, if the current monopoly regulatory position were to remain, the rest of Canada combined is forecast to continue to languish below 15 percent, with an onshore rate of around 11 percent in 2024 becoming 13 percent by 2028.

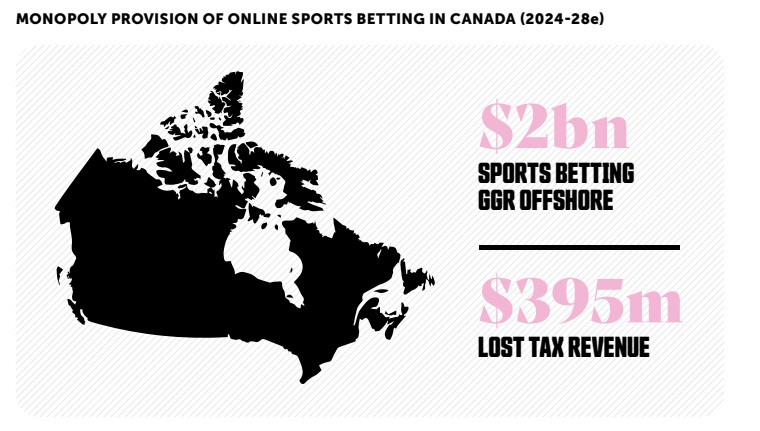

To put this into perspective, Canada (excluding Ontario) is forecast to lose nearly CA$2 billion in taxable sports betting GGR offshore during 2024-28. Using the same tax model as Ontario, that equates to around CA$395 million in lost tax revenue. Alberta, Quebec and British Columbia combined account for around 75 percent of that figure.

Alberta is reported to be considering adopting a licensing model similar to Ontario’s for online gambling regulation. If that model was introduced from the start of 2025, that could bring around CA$400 million in taxable sports betting GGR back onshore during 2025-28, based on current offshore market forecasts. However, a regulated commercial market would also be expected to grow the overall market and the true, taxable, gross gaming revenue potential is therefore expected to be higher.

Whilst it is a fundamental pillar of any successful onshore sports betting market, operator licensing and the related availability of betting services cannot alone be expected to achieve a high onshore consumer channelling rate nor taxable returns. The establishment of a successful market is also linked to the types of sports betting products that operators are permitted to offer and wider issues such as taxation, licensing costs, advertising, bonuses, and the availability of other forms of gambling.

Sports Alerts Slump

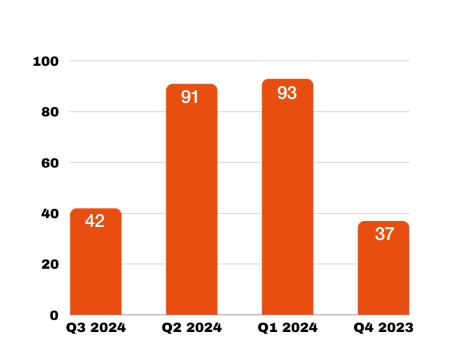

The International Betting Integrity Association (IBIA) and its growing membership now monitor over $300 billion per annum in betting turnover (handle) across more than 125 sports betting brands globally, making IBIA the largest betting-integrity monitor of its type for private operators in the world. The third-quarter 2024 total of alerts (42) is a decrease of 54 percent when compared to the total revised 91 alerts of the second quarter. It is a decrease of 16 percent, when compared to the revised third quarter total of 2023, which saw 50 alerts.

The five alerts on sporting events in Africa is a decrease on the number of alerts reported on African events for the second quarter of 2024 (11), but an increase on the number of alerts reported on African events for the third quarter of 2023 (two).

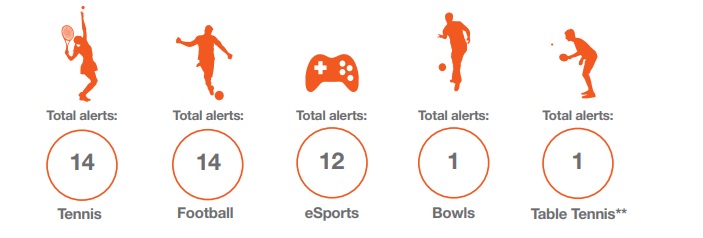

The 14 tennis reports represent a 40 percent increase on the 10 reported in in the second quarter of 2024, but represents no change on the 14 reported in the first quarter. However, they also represent a seven percent decrease when compared to the same quarter of 2023.

The International Betting Integrity Association (IBIA) represents many of the largest regulated betting operators

in the world. Its principal goal is to protect its members, consumers and partners, such as sports bodies, from fraud caused by the unfair manipulation of sporting events, and associated betting. The association combats this fraud with evidence-based intelligence, principally obtained from its global monitoring and alert system.