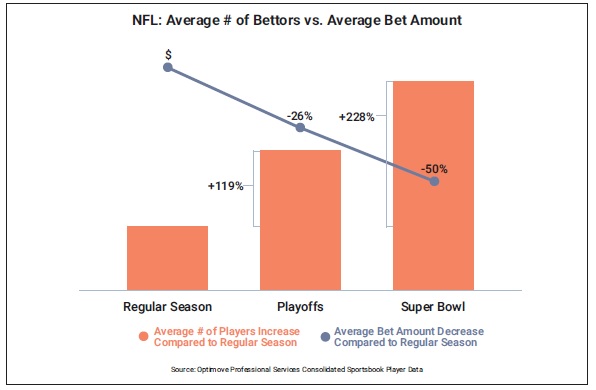

Optimove’s analysis of 10 million-plus NFL bets shows that a surge in bettors correlates with reduced average wager amounts

Optimove analyzed sports book players’ behavior based on over 10 million NFL bets from September 2022 to February 2023, comparing the NFL regular season to the playoffs and Super Bowl. Optimove is a CRM marketing platform used by four out of five of the top U.S. sports book operators, plus others. As a result, Optimove has access to aggregated data of player betting trends and volume.

The data revealed that as the 2023 NFL season reaches its final stages (the latest complete season data as of this writing), a surge in betting volume coincided with a reduction in the average bet amount. The total number of bettors increased from the regular season to the playoffs, with the most during the Super Bowl. Compared to the regular season, the playoffs saw a 119 percent increase in the number of bettors. This figure soared to a 228 percent increase compared to the regular season for the Super Bowl.

Conversely, the average daily bet amount per bettor on playoff games was 26 percent lower than during regular season games. And the average bet amount during the Super Bowl game day was 50 percent of the regular season. This trend suggests a surge in new participants, primarily placing smaller bets, driven by the allure of major games.

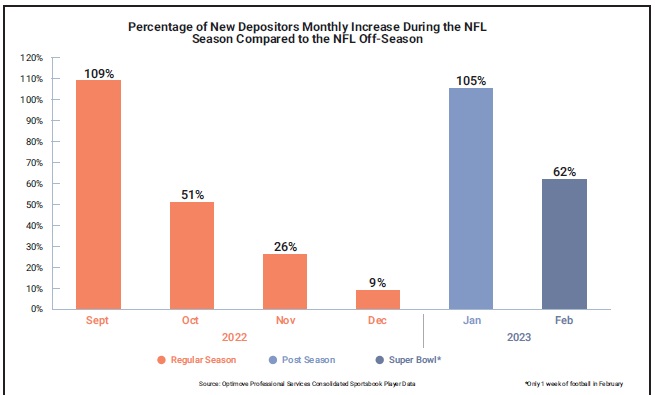

Increase in the monthly average number of first-time depositors

Similar to major sporting events, the NFL season attracts a substantial influx of new depositors (individuals making an initial deposit into their accounts) particularly during its final stages. Optimove data shows an increase in the monthly average number of first-time depositors compared to the average over the previous six months without football.

In September, the surge surpassed the previous six-month average for first-time depositors by 109 percent, followed by October with a 51 percent increase, November with a 26 percent uptick, and December — marking the end of the regular season — with a nine percent rise. Interestingly, as the playoffs commenced in January, there was a 105 percent increase, and February recorded a 62 percent surge, despite only one week of football, which culminated in the Super Bowl.

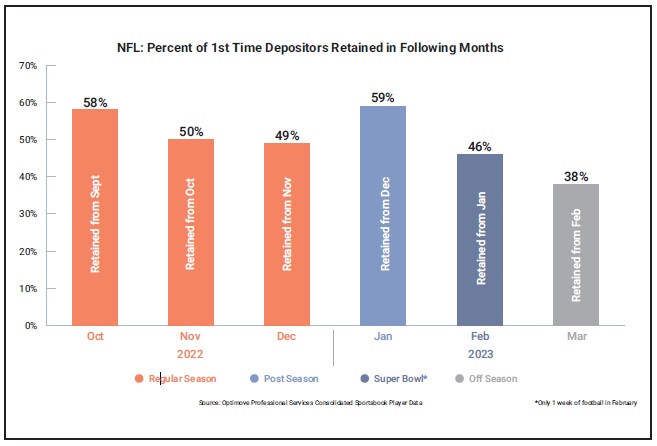

Player retention rates plummet post-Super Bowl

The data sheds light on intriguing trends in the retention rates of first-time depositors (bettors) during the NFL season. The findings reveal a notable decrease in retention rates in the subsequent month following the regular season, with a noteworthy spike in retention observed in January, the playoff month.

Fifty-eight percent of September first-time depositors remained active in October. As the season progressed into November and December, approximately half of the new depositors were retained as active from the previous month. Interestingly, the playoff month of January saw a significant uptick, with 59 percent of the new depositors remaining active from December. In February, this retention figure remained strong at 46 percent, reflecting the sustained engagement of players from the playoff period.

Even as the NFL season concluded, in March, our data indicates that operators successfully found new games to captivate bettors, evinced by a retention rate of 38 percent from February. This continued engagement suggests the allure of alternative events, possibly those associated with March Madness.

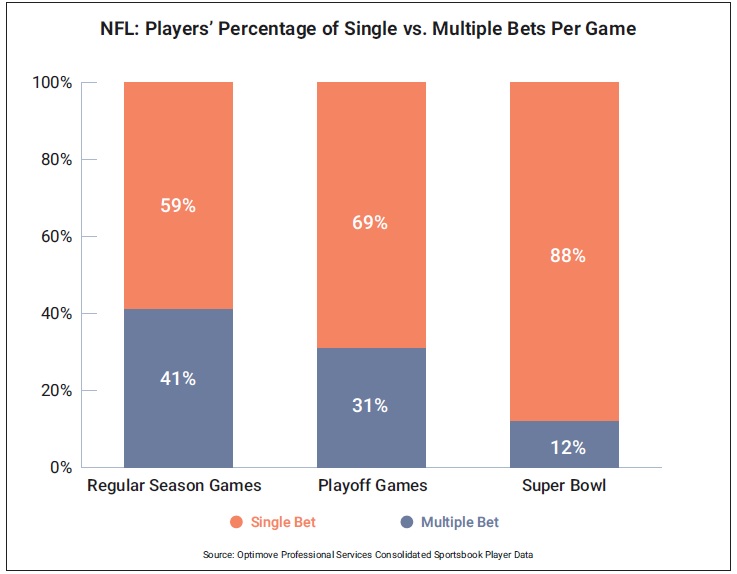

Single bet vs. multiple bets per game

In terms of betting preferences, the data highlights a discernible inclination among players toward single bets, and this inclination intensifies as the Super Bowl draws near. This pattern underscores a player preference for simplicity, indicating a penchant for straightforward bets, particularly as a growing number of new players participate in the NFL sports book wagers.

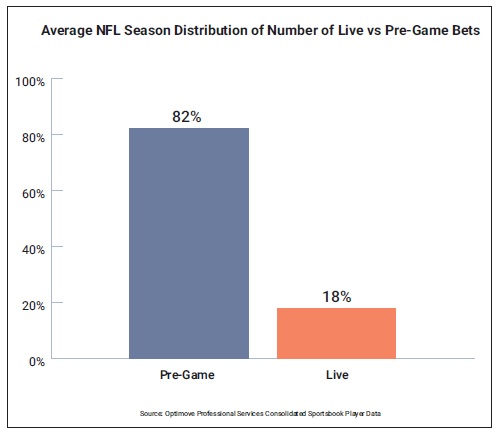

Live bettors wager more

Live bets, occurring in real-time as a game unfolds, constitute a pivotal facet of sports gaming, and the analysis unveiled pre-game bets as the overwhelming preference. Eighty-two percent of players exhibited a preference for pregame bets throughout the season, with just 18 percent opting for live bets. Interestingly, despite the lower prevalence of live bets, the average wager amount for these live bets was 1.6 times higher than pregame wagers, pointing to the inclination of more seasoned players to engage in higher-stakes bets during live game play.

Understanding the player’s lifecycle stages (new -> activated -> churned -> reactivated) is an essential stride in tailoring experiences for sports book operators. This understanding empowers operators to deliver highly pertinent content to players, shaped by their historical engagement with the brand. It serves as a strategic opportunity to attract new players and rekindle engagement from those who may have become dormant.

*** This Exclusive Report was originally published January 2024 in Sports Betting Operator Issue 009 ***