Report provided by the International Betting Integrity Association

The recently published “The Availability of Sports Betting Products: An Economic and Integrity Analysis” study examines the comparative impact of restrictive and liberal market regulation of sports betting products on consumer protection, regulatory oversight, taxable revenue, marketing and sports integrity.

Prepared by H2 Gambling Capital, the leading authority regarding market data and intelligence on the gambling industry, the study is based on actual operator data, International Betting

Integrity Association (IBIA) alert data and H2’s own market data.

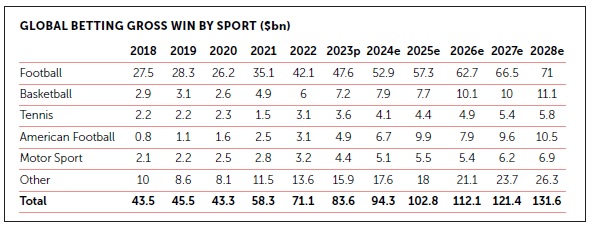

The study forecasts that regulated global sports betting will be worth $94 billion in gross gambling revenue (GGR) in 2024, with 65 percent ($61 billion) generated via online bets. It is

forecast to reach approximately $132 billion by 2028, with over 70 percent ($93 billion) online. Its analysis focuses on the core sports betting products – in-play, football, tennis and basketball

betting – that drive that growth globally. It also assesses the market impact of the availability of those core sports betting products. The central finding is that there is a strong correlation between the wide availability of sports betting products and the proportion of consumers who

place bets with onshore, regulated sports betting operators.

This correlation is thereby reducing the risks of exposure to sports betting related fraud on unlicensed markets. It also highlights specific betting markets that have a disproportionate

impact on the market and the onshore channelling rate due to their size and popularity. This includes football, which dominates sports betting globally, and tennis, which is particularly strong in Europe. Products like ‘in-play,’ ‘side markets’ (e.g. cards and corners) and ‘prop’ betting also have a very significant impact on channelling.

New data challenges the assumption that these markets represent a heightened risk of match-fixing related that restricting their availability via regulated onshore operators significantly increases the number of consumers using riskier unlicensed offshore operators.

A blunt and counterproductive instrument Khalid Ali, CEO IBIA:

“Whilst politically attractive, the study confirms that bet restrictions are a blunt and counterproductive instrument. They don’t prevent betting, they just drive it into the unregulated market where most of the problems with sports integrity arise. The conclusions are clear: If you want to protect consumers and sports from corrupters, while maximizing tax revenues, then allowing a wide range of sports betting products is essential.”

Licensing is Fundamental to a Successful Market

The regulatory and licensing framework provides the foundation of any policy on the availability of betting, both land-based and online. Many countries have historically regulated the supply of betting services through a monopoly operator, often state-owned and land-based. Choice and competition are consequently restricted, as are related product attractiveness and innovation.

With the advent of online betting, that predominantly land-based supply has been challenged by offshore betting services, often providing a modern, broader product catalogue.

The consumer migration to those offshore services has resulted in jurisdictions losing oversight and control of consumer gambling activity, along with taxable revenues. This has caused policymakers around the world to reconsider their regulatory approach to the availability of sports betting services, notably online.

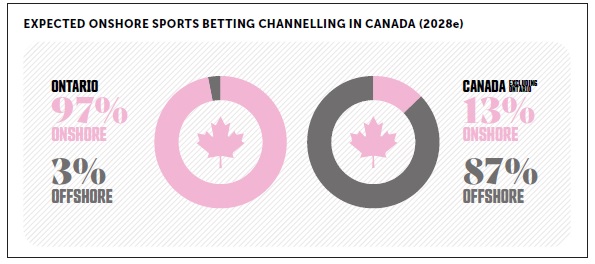

The Canadian experience

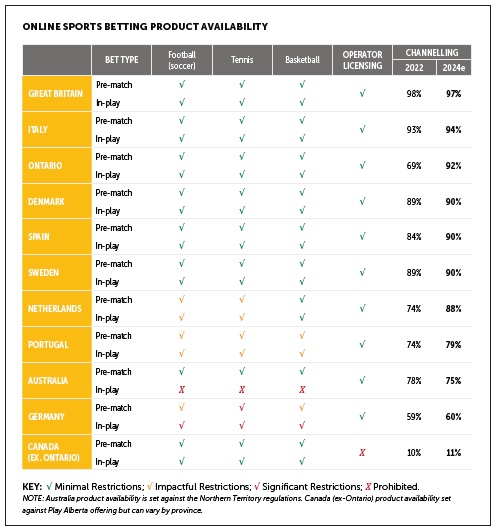

Ontario is a useful case study. It broke away from the monopoly model in operation across Canada and introduced an online sports betting-licensing system that has been operational since April 2022. As a result, Ontario’s onshore sports betting channelization is expected to reach 92 percent in 2024. In contrast, the rest of Canada combined is forecast to have an onshore rate of around 11 percent and is expected to lose $2 billion in taxable sports betting GGR offshore during 2024-8.

While operator licensing and the related availability of betting services are fundamental pillars of any successful, onshore sports betting market, they cannot alone be expected to ensure a high onshore consumer channelling rate and taxable returns.

The establishment of a successful market is also linked to the types of sports betting products that operators are permitted to offer, as well as wider issues such as taxation, licensing costs, advertising, bonuses and the availability of other forms of gambling.

Impact of In-Play Sports Betting

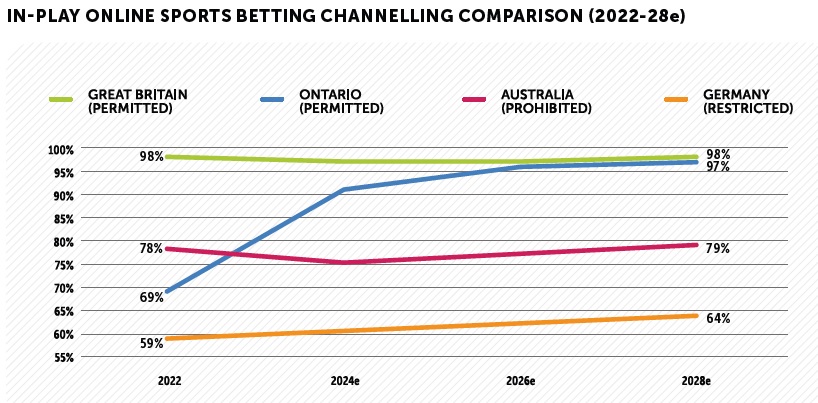

Just under half (47 percent) of all sports bets are forecast to be placed in-play (or live) in 2024, equating to around $28.4 billion in GGR. In-play betting is a particularly popular product with consumers and is forecast to account for 51 percent ($47 billion) of sports bets by 2028. Understandably, most jurisdictions in the study, and indeed more generally where betting is regulated, permit a wide availability of in-play betting through both land-based and online channels.

Australia, however, has banned all online in-play sports betting, which is the primary reason for its low onshore-consumer-channeling rate, which is expected to remain relatively stagnant (78 percent in 2022 to 79 percent in 2028) under the current regulatory regime. The adverse impact on channelization is also apparent in Germany, which restricts in-play betting to a limited number of markets compounding wider betting-product restrictions. Germany is forecast to have a relatively low, 60 percent, onshore channelization in 2024.

In contrast, jurisdictions that permit in-play betting have noticeably higher onshore consumer-channelization rates. Ontario, which only opened its market in 2022, immediately overtook the German market’s onshore sports betting-channelization rate and is expected to overtake Australia’s in 2023-4. Ontario is expected to have a 92 percent onshore rate in 2024. Whilst the well-established market in Great Britain, which similarly permits in-play betting, is forecast to have 97 percent onshore channelization.

A lack of in-play betting is one of the most distortive restrictions in sports betting markets, driving consumers offshore. It intensifies an already burdensome fiscal operating position in both Australia and Germany. It has been calculated that, over a five-year period, the legalization of online in-play in Australia would lead to around $1 billion of additional incremental tax revenues being brought onshore.

For Germany, this figure would be over $400 million. A common rationale for limiting or prohibiting in-play betting is a supposedly heightened integrity risk (compared to pre-match). However, this argument lacks a firm evidence base: Most in-play markets can be offered pre-match. Furthermore, an analysis of the suspicious betting covering all sports during 2020- 23 shows that around half (49 percent) had a pre-match element. Prohibiting or restricting in-play betting also does not unduly hinder corrupt activity, especially with a sizeable offshore unregulated (or black) market available, notably based in Asia.

Maximizing onshore channelization, regulatory oversight, taxable revenues and associated consumer protections, and sporting-integrity benefits, requires an attractive product offering. The availability of in-play betting is fundamental to that.

Football: The Key Driver Of Onshore Channelling

Betting on football (soccer) is forecast to generate $53 billion in GGR from around $570 billion in turnover in 2024 and is the dominant sports betting product, with over 56 percent of the regulated betting market gross win globally. It is a strong online product, providing nearly 65 percent of all football GGR. Europe and Asia are forecast to account for 85 percent of all (online and land-based) football betting GGR in 2024.

It is particularly noticeable that consumer onshore channelling is lower in markets that restrict football betting products. That channelization is impacted both by any limitation on the sporting competitions on which bets may be placed and by the types of bets offered.

The main football betting markets (result, handicap, goals) generate the highest spend and are widely offered in most regulated jurisdictions. These markets are forecast to generate over $500 billion in turnover in 2024, with $370 billion coming from online betting, and a total gross win of $46 billion. The availability of these markets therefore has a significant impact on consumer engagement with onshore licensed sports betting operators.

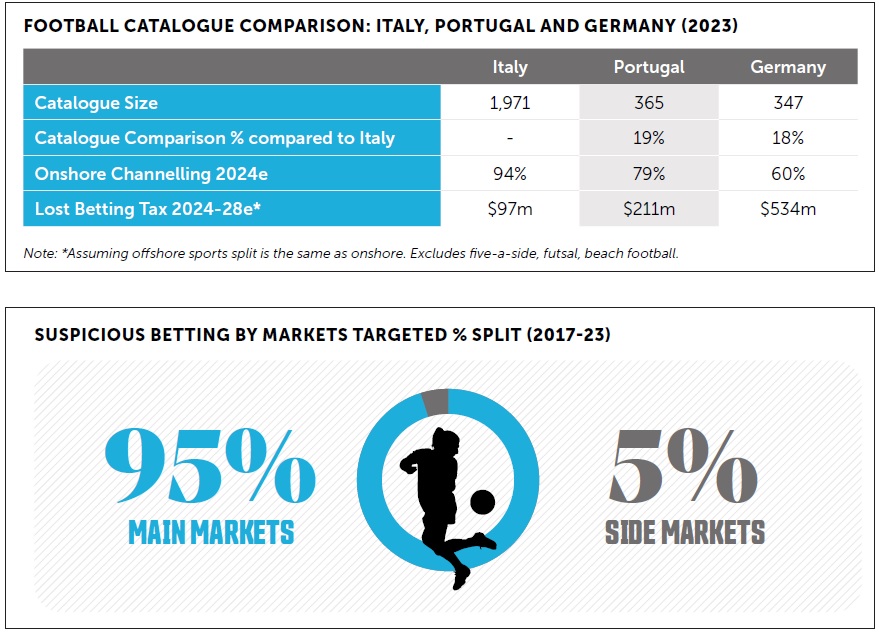

It is therefore unsurprising that onshore channelling is noticeably lower in jurisdictions that place restrictions on these core football-betting products. The approaches employed by Portugal and Germany are particularly restrictive: They offer only 18-19 percent of the competitions permitted in Italy, for example, and lag some way behind Italy’s 94 percent onshore channelization.

The two countries are forecast to have a combined loss offshore of around $750 million in taxable revenues from football betting during 2024-8. There appears to be no clear rationale for these market restrictions: IBIA reported 359 matches that were the subject of suspicious activity in the main football-betting markets from around 950,000 matches offered for betting during 2017-23, suggesting a relatively low integrity risk.

Restrictions on a core product like the main football betting markets penalize onshore operators and consumers, and serve to encourage the latter to seek prohibited betting products offshore. Establishing a viable and effective, regulated, onshore betting market requires a wide product range to be available and one that is importantly able to compete with any offshore offering unhindered by product restrictions.

Side markets (cards and corners) are the subject of a wider set of limitations amongst the jurisdictions in the study.

It should be noted that the majority do not impose any restrictions. There is significant consumer demand for these products, which are forecast to account for around $70 billion in turnover and nearly $7 billion in GGR in 2024. To put that into perspective, it is larger than the total wagered on any other sport globally except for basketball and American football.

Seeking to restrict a product with that level of demand significantly heightens the drive for consumers to migrate offshore, where such markets are freely offered, unhindered by restrictions. However, the integrity risk is relatively low, with only five percent of suspicious betting market activity involving side markets. They are clearly not a favoured product for corrupters to target, with increased internal risk-management protocols and lower maximum-stake sizes often imposed relative to the main football markets.

The Netherlands prohibits cards-and-corners betting. The operator market data supplied for the study, along with data from other markets, suggests that the football market would increase by approximately 18 percent with the addition of those markets. That would generate an extra $118 million of tax revenue in the Netherlands over the next five years. In reality, the increase in tax revenue could be much higher, as it would bring some offshore players back onshore, capturing all of their offshore spend.

Negative Impact of Restrictive Tennis Product Offerings

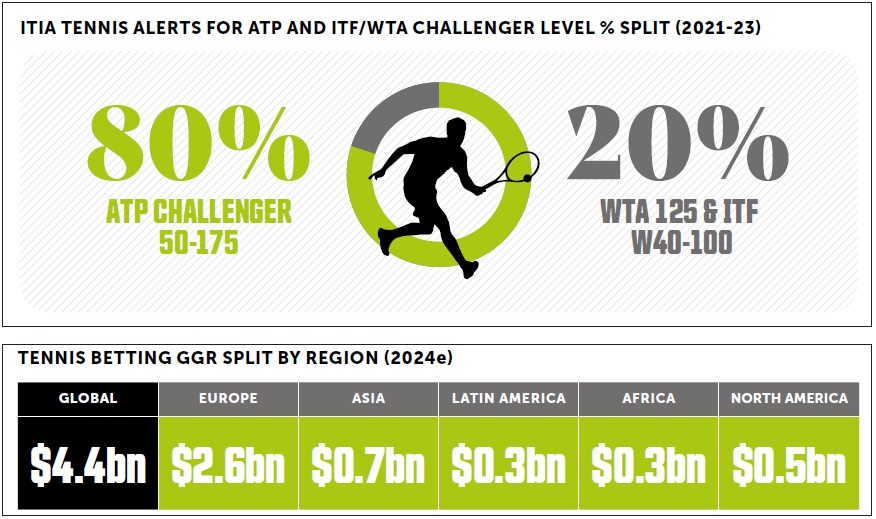

Tennis is one of the most popular sports globally for betting, notably online. This is due to the sheer volume of matches worldwide and regular availability of competitions during the average week. The global regulated market is expected to reach $4.4 billion in GGR in 2024 and is forecast to be over $6 billion annually by 2028.

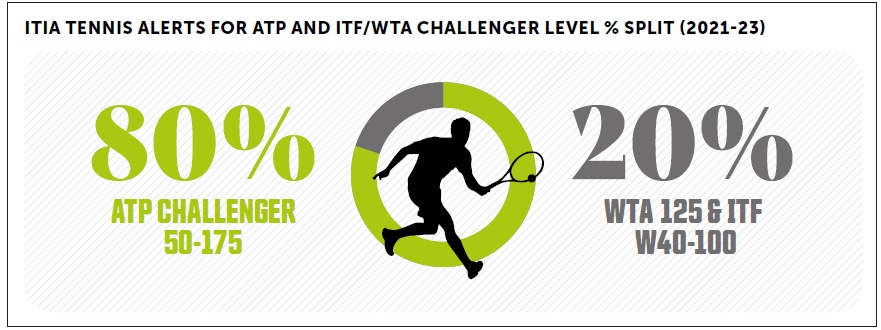

Tennis betting is a particularly strong product in Europe, which accounts for around 60 percent of global tennis GGR. Strong growth is also expected in North America, with a doubling in tennis betting GGR to around $1 billion by 2028. The main consideration regarding the availability of betting on tennis has been the ITF Tour, which has been banned in some jurisdictions due to perceived integrity concerns. The main tennis tours have, in general, shown a marked reduction in suspicious-betting alerts in recent years. While alert numbers may be higher, as a result of a significant number of additional tournaments – accounting for 76 percent of all tennis tours – the ITF Tour does not pose a heightened integrity risk compared to the other tours, from an alert-to-tournament/match-ratio basis.

It is also important to recognize that the ITF W40-100, along with the WTA 125, are equivalent to the ATP Challenger Tour. The Challenger Tour is widely permitted, including in Portugal. However, in that jurisdiction the ITF W40-100 is prohibited, even though it accounts for only 20 percent of alerts compared to 80 percent with the ATP Challenger Tour. A blanket ban of all ITF tennis is disproportionate and counterproductive.

There is clear demand for the ITF product, which accounts for 17 percent of tennis wagering globally and 43 percent of all matches offered. It is therefore no surprise that the Portuguese market generates a significantly lower proportion of wagering turnover on tennis than neighbouring countries that permit ITF betting, like Spain and Italy. If Portugal established a similar market to those countries, it would be expected to generate an extra $122 million in tax revenue over the next five years.

Enforcing a complete ban on ITF Tour betting clearly acts as a driver to access ITF products via the offshore market, where it is globally available. Prohibition also fails to recognise the nuances that exist between the various levels of that tour and the associated integrity risk, which has vastly improved.

Global Growth of Basketball Prop Betting

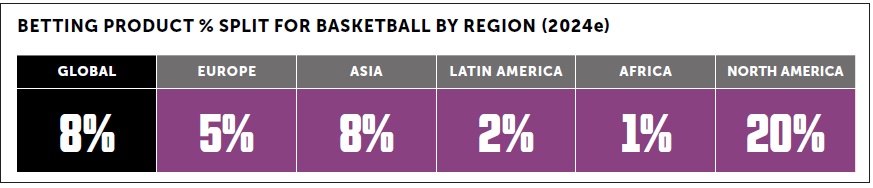

North America is forecast to reach around $5.4 billion in basketball GGR by 2028 and will drive the majority of basketball betting growth globally, which is forecast to increase from $7.9 billion in 2024 to $11 billion in GGR in 2028. However, that will be supported by strong growth in Europe and Asia with over 20 percent and 30 percent increases in GGR to $2.3 billion and $3.2 billion expected during this period.

Most jurisdictions assessed in the study permit a wide availability of basketball competitions and types of bets, with resultant high onshore channelization. The $1.7 billion in GGR forecast to be generated in Europe in 2024 is achieved despite the adverse impact of product restrictions in Portugal and Germany, which are particularly restrictive and counterproductive. This is contributing to a noticeably lower onshore channelization relative to product-permissive jurisdictions such as Great Britain and Italy.

The availability of proposition (prop) betting has been a particular focus of discussion in the burgeoning North American market. It is widely permitted outside of the U.S. but prohibited by some U.S. states on integrity grounds, notably player props. Given that around 55 percent of global basketball betting GGR in 2024 is expected to be outside of North America, it is reasonable to presume that prop betting on NBA and NCAA matches outside of the U.S. may exceed that of any individual U.S. state that may ban such activity.

Indeed, player-prop betting is widely permitted in other parts of North America such as the Canadian provinces of Ontario and Alberta. As the U.S. and the wider North American sports betting market continues to evolve, notably driven by the adoption of more in-play activity (predicted to account for 65 percent of bets by 2028), products such as team and player props are expected to gain increased traction with North American consumers.

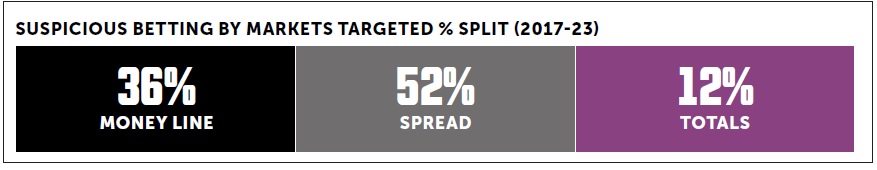

The operators in the study reported 59 basketball matches as being the subject of suspicious betting between 2017-23 from around 360,000 basketball matches offered for betting, suggesting a relatively low integrity risk. That suspicious betting was confined to the core markets (money line, spread, totals); there was no suspicious betting activity linked to match manipulation identified on player-prop markets.

There is no meaningful integrity benefit from excluding such markets, which are widely available globally. Prohibiting those products will make offshore operators more attractive. More effective and proportionate approaches to product availability are employed in many jurisdictions that serve to contribute to strong onshore market integrity, high onshore channelization, related taxation and regulatory oversight.

Importance of Monitoring and Alert Networks

Prohibiting the availability of betting markets is counterproductive to onshore channelization and integrity protection. A range of more effectiveintegrity measures are employed by regulatory authorities, such as information sharing and voiding suspicious bets. However, the principal means of protecting a market is through operators monitoring their customers’ transactions and sharing details of suspicious betting activity with a wider international-monitoring network.

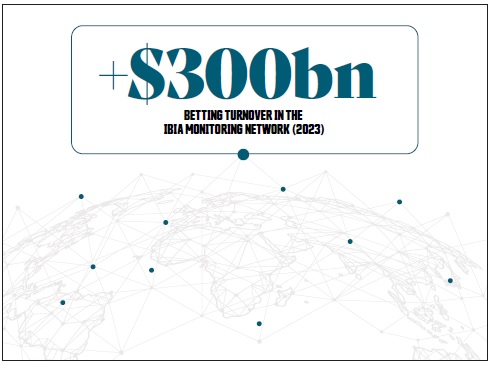

This approach has proven to be highly effective and has been adopted as a licensing requirement across a number of European and North American markets and forms a central pillar of the new Brazilian regulatory framework. The study utilized customer account data from the International Betting Integrity Association (IBIA) – which is the largest monitor of its type in the world – and its members, who account for over $300 billion of global betting turnover (handle) per annum.

Emerging Sports Betting Markets

There are a number of jurisdictions that are in the process of regulating their online sports betting markets, notably across North and South America. Of particular significance is the proposed gambling regulatory change in Brazil. The current expectation is that a liberal market will be established in Brazil, which will achieve both a high onshore-channeling rate and tax returns from a forecast $2.3 billion in GGR in 2025. It is calculated that this approach could achieve $34 billion in sports betting turnover and $2.8 billion in onshore GGR by 2028.

Recommendations for Maximising Onshore Activity

This study shows that sports betting-product restrictions adversely impact onshore channelling, and that in turn has negative consequences for regulatory oversight and taxable revenues. The central recommendation of this study is, therefore, that jurisdictions should permit a wide sports betting product range with onshore operators or accept that consumers will seek banned products offshore, and that regulatory oversight and tax revenue will be lost.

Alternatives to Prohibition

Whilst it may deliver the optimum market solution, it is acknowledged that moving from an existing approach of prohibition to permitting certain betting products is likely to prove a challenging step for some policymakers, even with clear evidence to support that approach. In that instance, consideration should be given to identifying the product-related reasons for offshore migration and how to make the onshore market more attractive without imposing ineffective, resource-intensive barriers. Whilst not delivering the optimal onshore market solution, proportionate, product-targeted options are more favorable to prohibition.

Sports Betting Integrity

The rationale for prohibiting markets is often on integrity grounds. But that approach is often not proportionate to the level of risk and is based on flawed or unevidenced data. The principal

means of protecting the integrity of a betting market and associated sporting events is through monitoring, and it is increasingly recognized that there is clear value from operators being

part of a wider, international, integrity monitoring network. Nearly half of the jurisdictions in the study have adopted legislative provisions requiring licensed operators to be part of an international integrity-monitoring body, as have many newly regulated states across

the U.S. An international issue requires an international approach.

About this Study

The purpose of the study is to provide a data-driven evidence base upon which policymakers can make more informed judgements about the availability of regulated sports betting

products and how best to respond to growing consumer demand for these products, while strengthening oversight of the onshore market and the fight against match-fixing.

The study analyzes and compares 12 jurisdictions where there is currently a wide variation of regulatory approaches: Great Britain, Italy, Ontario, Denmark, Spain, Sweden, Netherlands, Portugal, Australia, Germany, Canada (excluding Ontario) and Brazil. The US market is not

specifically included due to the number and variety of state regulatory models but may be the subject of bespoke analysis at a future stage.

The study was developed in partnership with: Instituto Brasileiro de Jogo Responsável, Canadian Gaming Association Netherlands Online Gambling Association, and Responsible Wagering Australia.