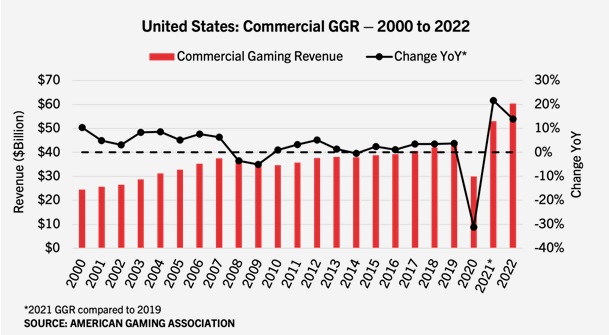

According to data compiled by the American Gaming Association (AGA), commercial gaming revenue – encompassing traditional casino games, sports betting and iGaming – reached $60.42 billion in 2022, a 13.9 percent increase over 2021 and 38.5 percent higher than 2019.

Total annual U.S. gaming revenue in 2022 will likely exceed $100 billion for the first time. This will be confirmed when tribal gaming revenue is reported by the National Indian Gaming Commission later this year. For context, combined commercial and tribal casino gaming is on par with overall U.S. beer sales, which hit $100.2 billion in 2021.

On a monthly and quarterly basis, the gaming sector closed out 2022 on a high note despite the broader economic environment and tougher comparisons to the previous year. The fourth quarter saw a 10.5 percent year-over-year increase in commercial gaming revenue to $15.85 billion, while December marked the single highest grossing month on record with a 16.7 percent year-over-year increase to $5.43 billion

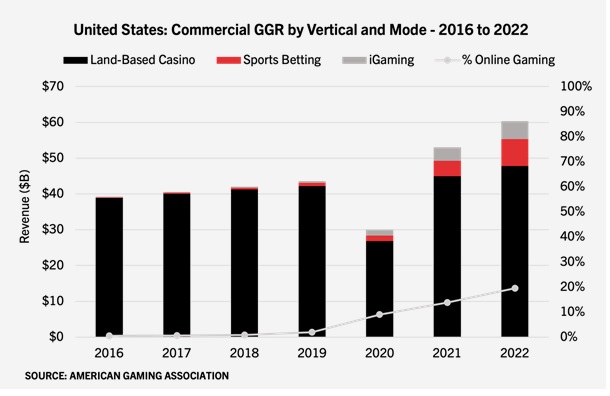

Growing the Pie: In-Person Gaming Has Record Year, Online Now One-Fifth of Revenue

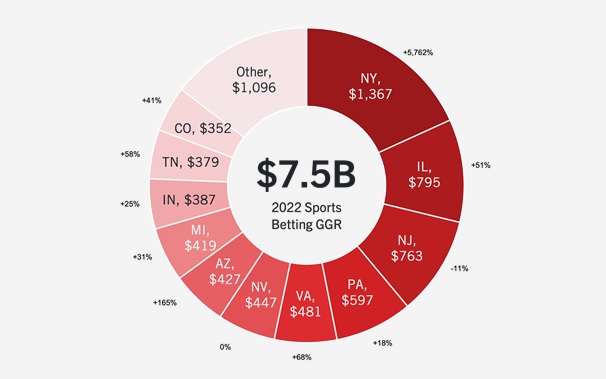

Each of the three major verticals – casino slots and table games, sports betting and iGaming – generated individual revenue records in 2022. Casino slots and table games generated a combined total of $47.83 billion, accounting for 79.3 percent of total commercial gaming revenue. Sports betting brought in $7.50 billion (12.4% of total) while iGaming totaled $5.02 billion (8.3% of total).

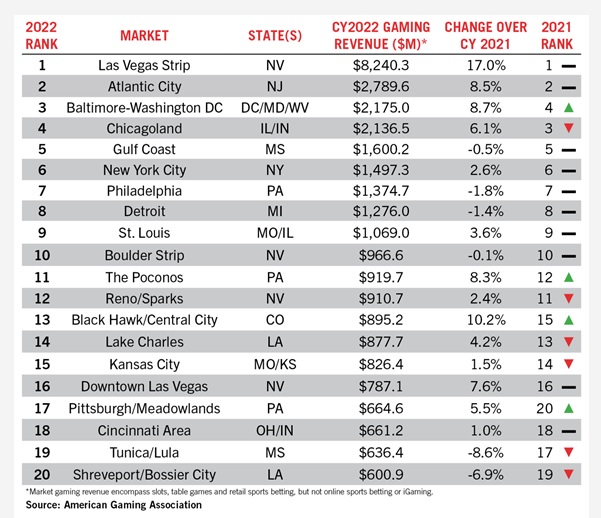

Top Casino Markets, Properties See Continued Reshuffling

In 2022, 14 of the top 20 commercial casino gaming markets posted revenue growth compared to the previous year. After a turbulent two years with markets rising and falling largely due to varying pandemic restrictions, market rankings stabilized in 2022. The Baltimore-Washington, D.C (DC/MD/WV) and Chicagoland (IL/IN), markets continued their back and forth between the third and fourth largest markets, with the D.C. area reclaiming its spot as the third largest market.

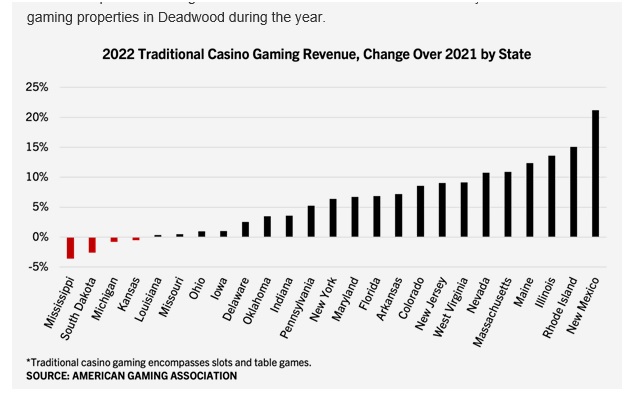

Powered by Rebounding Visitation and Strong Consumer Spend, Brick-and-Mortar Gaming Sets New Record

In 2022, traditional casino gaming continued to thrive, with combined slot and table game revenue increasing by 6.4 percent to an annual record of $47.83 billion. Slot revenue saw a 5.1 percent year-over-year increase, while table revenue rose 13.9 percent, reversing the 2021 dynamic where lingering COVID-related restrictions had a greater impact on table game operations. Compared to 2019, both verticals accelerated in 2022 at an almost identical rate, with slot revenue rising by 15.7% and table game revenue increasing by 15.1%.

Nearly all markets with brick-and-mortar slot machines and/or table games experienced yearly growth, with only four states contracting: Kansas (-0.5%), Michigan (-0.8%), Mississippi (-3.6%) and South Dakota (-2.6%). Mississippi and South Dakota had been quick to lift pandemic restrictions in 2020/2021 and were disproportionally impacted by difficult annual comparisons throughout 2022. South Dakota was also affected by the closure of three gaming properties in Deadwood during the year.

Sports Betting and iGaming Accelerate to Record Year and Quarter

While land-based gaming still dominated the overall gaming revenue pie, sports betting and iGaming saw tremendous growth in 2022, setting new annual records including quarterly highs in Q4.

Nationwide sports betting revenue soared 72.9 percent year-over-year, from $4.34 billion in 2021 to $7.50 billion in 2022, as Americans bet a total of $93.2 billion on sports throughout the year. The growth was driven by the launch of legal betting in Kansas and the addition of mobile betting in Louisiana, Maryland and New York.

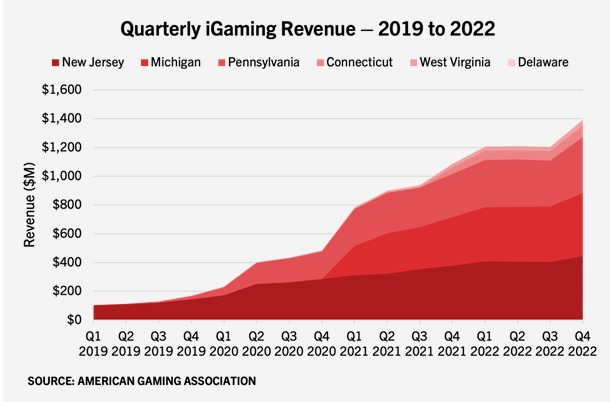

The geographically smaller iGaming market also continued to break records in 2022, with combined iGaming revenue from six active states (excluding Nevada) reaching $5.02 billion, a 35.2 percent increase year-over-year. Notably, iGaming’s growth came without any new states launching in 2022.

The year ended on a high note with the vertical setting a new quarterly record of $1.39 billion in revenue, up 28.2 percent from Q4 2021. Each of the five iGaming markets that were operational throughout 2021 set new annual records for the vertical, as revenue expanded between 15.9 percent (NJ) and 90.2 percent (WV) on the previous year.

The geographically smaller iGaming market also continued to break records in 2022, with combined iGaming revenue from six active states (excluding Nevada) reaching $5.02 billion, a 35.2 percent increase year-over-year. Notably, iGaming’s growth came without any new states launching in 2022.

The year ended on a high note with the vertical setting a new quarterly record of $1.39 billion in revenue, up 28.2 percent from Q4 2021. Each of the five iGaming markets that were operational throughout 2021 set new annual records for the vertical, as revenue expanded between 15.9 percent (NJ) and 90.2 percent (WV) on the previous year.

Quarterly iGaming Revenue – 2019 to 2022

Source: American Gaming Association