6 March 2024: The International Betting Integrity Association (IBIA) has today launched ‘The Availability of Sports Betting Products: An Economic and Integrity Analysis’ study.

The study has been prepared by H2 Gambling Capital, the leading authority regarding market data and intelligence on the gambling industry.

It analyses the comparative impact of restrictive and liberal market regulation of sports betting products on consumer protection, regulatory oversight, taxable revenue, market and sports integrity. It draws on sports betting operator data, IBIA alert data, and H2’s own market data, and was developed in partnership with: Instituto Brasileiro de Jogo Responsável, Canadian Gaming Association, Netherlands Online Gambling Association, and Responsible Wagering Australia.

The study’s central finding is that there is a strong correlation between the wide availability of sports betting products and the proportion of consumers who place bets with onshore regulated sports betting operators (known as the channelling rate), thereby reducing the risk of exposure to sports betting related fraud on unlicenced markets.

The study’s central finding is that there is a strong correlation between the wide availability of sports betting products and the proportion of consumers who place bets with onshore regulated sports betting operators (known as the channelling rate), thereby reducing the risk of exposure to sports betting related fraud on unlicenced markets.

It also highlights specific betting markets that have a disproportionate impact on the market and the onshore channelling rate due to their size and popularity. This includes football, which dominates sports betting globally, and tennis, which is particularly strong in Europe. Products like ‘in-play’, ‘side markets’ (e.g. cards and corners) and ‘prop’ betting also have a very significant impact on channelling.

New data challenges the assumption that these markets represent a heightened risk of match-fixing related fraud, while demonstrating that restricting their availability via regulated onshore operators significantly increases the number of consumers using riskier unlicensed offshore operators.

Khalid Ali, CEO IBIA, said: “Whilst politically attractive, this study confirms that bet restrictions are a blunt and counterproductive instrument. They don’t prevent betting, they just drive it into the unregulated market where most of the problems with sports integrity arise. The conclusions are clear: if you want to protect consumers and sports from corrupters, while maximising tax revenues, then allowing a wide range of sports betting products is essential.”

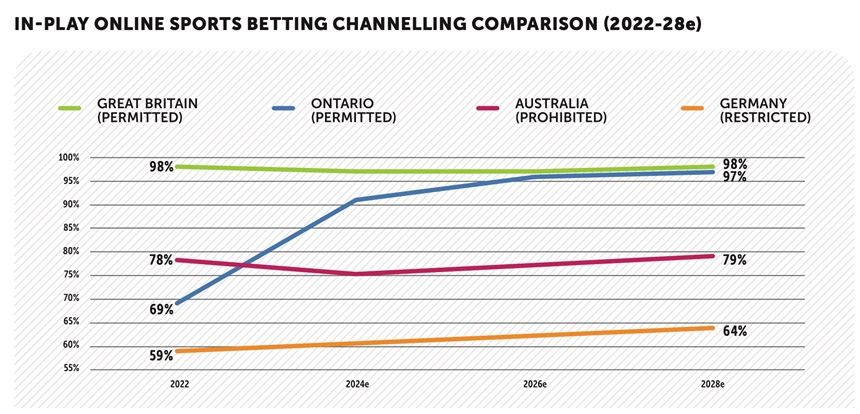

David Henwood, Director at H2, added: “We always fall back on the data. There is much conjecture that one of the main reasons customers use offshore betting sites is because they offer a broader range of product than available onshore. The study findings reinforce that point of view. Limiting the choice of onshore bet types – including live in-play – is basically counter-productive. Instead, markets most successful in limiting offshore play – evidenced by a channelling rate of 90% plus – are the ones that have generally opened their onshore provision to a broad product choice. There is much that can be learnt herein in terms of best practice regulation.”

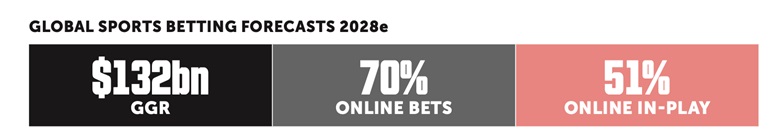

The study details the growing global popularity of sports betting. In 2024, global sports betting is forecast to be worth $94bn in gross win, and reach approximately $132bn by 2028, with over 70% ($93bn) online. Just under half (47%) of all online sports bets are forecast to be placed in-play (or live) in 2024, rising to 51% by 2028.

The study details the growing global popularity of sports betting. In 2024, global sports betting is forecast to be worth $94bn in gross win, and reach approximately $132bn by 2028, with over 70% ($93bn) online. Just under half (47%) of all online sports bets are forecast to be placed in-play (or live) in 2024, rising to 51% by 2028.

It also compares the success of different regulatory approaches to managing this growing demand. It finds that jurisdictions that allow a wide range of betting products, such as Great Britain (97%), have a much higher onshore consumer channelling rate than countries that restrict access to important betting markets, like Portugal (79%; restricts football and tennis), Australia (75%; prohibits online in-play) and Germany (60%; restricts football, tennis and in-play).

Beyond protecting consumers from match-fixing related fraud, these depressed onshore channelling rates are shown to have significant implications on tax revenue and market oversight. For instance, the study forecasts that:

- Australia would gain an additional $1bn in incremental tax revenues, and Germany an additional $400m, over the next five years if they permitted online in-play betting markets.

- Germany and Portugal are predicted to have a combined loss offshore of around $750m in taxable revenues due to restricted access to the main football betting markets between 2024-28.

- The Netherlands would experience a $118m uplift of tax revenue over the next five years if it liberalised access to football side markets (e.g. cards and corners).

- Portugal would benefit from an extra $122m in tax revenue over the next five years if it permitted availability of ITF tennis betting products to align with Italy and Spain.

The study’s findings are important for policymakers to consider as new jurisdictions – notably in North and South America – consider how best to regulate their online sports betting markets. In Brazil, for example, a regulatory framework with high product availability is expected to have $34bn in onshore sports betting turnover, providing $2.8bn in GGR, by 2028.

The experience of Ontario is also instructive. Having broken away from the Canadian monopoly model and introduced a licensing system in 2022, Ontario’s onshore sports betting channelisation is expected to reach 92% in 2024. In contrast, the rest of Canada combined is forecast to have a rate of around 11% and to lose $2bn in taxable revenues between 2024-28.

The experience of Ontario is also instructive. Having broken away from the Canadian monopoly model and introduced a licensing system in 2022, Ontario’s onshore sports betting channelisation is expected to reach 92% in 2024. In contrast, the rest of Canada combined is forecast to have a rate of around 11% and to lose $2bn in taxable revenues between 2024-28.

About the study and key additional findings

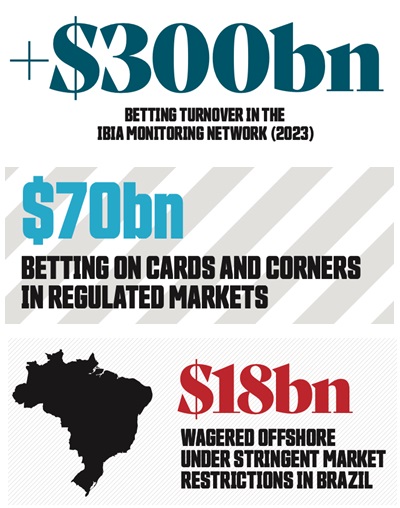

- It assesses the market impact of the availability of core sports betting products based on H2’s market data, actual operator data and IBIA’s alert data. IBIA’s monitoring and alert network covers global B2C betting turnover of over $273bn in 2023, and over $300bn if IBIA’s B2B members are included, and utilises account-based transactional monitoring data.

- Main football betting markets (result, handicap and goals) are forecast to generate over $500bn in turnover in 2024, with $370bn coming from online betting.

- Football side markets, notably cards and corners, are forecast to account for $70bn of turnover and $7bn in taxable revenues globally.

- The introduction of stringent product restrictions in Brazil would result in $18bn a year being wagered offshore and over $1bn in lost gambling tax over 2025-28.

- North America is forecast to reach around $5.4bn in basketball GGR by 2028 and will be supported by strong growth in Europe and Asia with over 20% and 30% increases in GGR to $2.3bn and $3.2bn expected during this period respectively.

- It is reasonable to presume that prop betting on NBA and NCAA matches outside of the US may exceed that of any individual US state that may ban such activity.

Partners

H2 Gambling Capital is a sector-specialist analyst company headquartered in the UK and is widely recognised as the leading authority regarding market data and intelligence on the gambling industry. We have strong professional credibility and impartiality, and a positive track record of delivering reports which stand up to scrutiny from a variety of stakeholders. Our independent analyses have helped many regulators and policymakers develop both improved regulation and optimum market trading conditions within their jurisdictions. (https://h2gc.com/)

- The International Betting Integrity Association (IBIA) is the leading global voice on integrity for the licensed betting industry. IBIA represents over 50 international gambling operators with over 125 sports betting brands and manages the largest customer transaction account-based integrity network in the world, covering over $270bn in betting turnover (handle) in 2023. (https://ibia.bet/)

- The Instituto Brasileiro de Jogo Responsável (IBJR), or Brazilian Institute of Responsible Gaming, represents many of the leading sports betting operators in Brazil and promotes the introduction of an effective regulatory framework of gambling in that country with clear rules and guidelines so that sports betting companies can operate legally, protecting the interests of players and civil society. (https://ibjr.org/)

- The Canadian Gaming Association (CGA) is the national trade association that represents leading operators and suppliers in Canada’s gaming, sports betting, eSports, and lottery industries. Its mandate is to advance the evolution of a regulated, responsible, and sustainable Canadian gaming industry through collaboration, education, and advocacy. (https://canadiangaming.ca/)

- The Netherlands Online Gambling Association (NOGA) advocates for online gambling companies who are committed to a safe, responsible and attractive online offer in the Netherlands. NOGA promotes constructive dialogue and advocates for a legislative framework that provides for an open licensing system in which the consumer is protected and the integrity in the market ensured. (https://www.no-ga.nl/)

- Responsible Wagering Australia (RWA) is the independent body for Australian licensed wagering service providers (WSPs). RWA and its members are at the forefront of promoting socially responsible wagering and advocating for increased standards in the sector. Members are bound by a Code of Conduct and must maintain the highest standards of integrity and probity. (https://responsiblewagering.com.au/)