What can Brazil’s emerging sports betting regulators learn from Portugal’s experience? By Khalid Ali, CEO of the International Betting Integrity Association (IBIA)

In the dynamic world of global sports betting, regulatory frameworks critically shape market dynamics, influencing everything from consumer behavior to economic outcomes and the integrity of sports.

Whilst they share a language, a tale of two diverse approaches to gambling regulation is unfolding in Brazil and Portugal. While Brazil is setting the stage for a Liberalised regime anticipated to launch in January 2025, Portugal has opted for a stringent regulatory model since opening to private operators in 2015. This article delves into the impacts of these divergent strategies and their impact on channelisation, sports integrity, and tax revenue. It outlines recent developments and draws on data to evaluate how each nation’s sports betting regulation is paving a path to protect markets, sports, and consumers from the threat of sports betting related match-fixing and fraud.

Regulation that cultivates a strong onshore-consumer channeling rate is an essential weapon in fighting match-fixing.

Assessing the impact of regulatory approaches on sports integrity initiatives requires an understanding of the mechanisms underpinning betting markets.

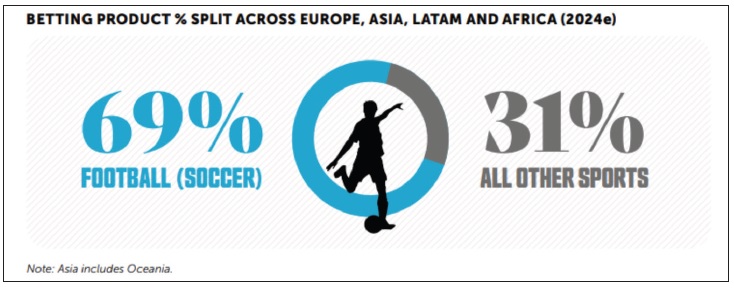

The findings of recent studies, including IBIA’s own The Availability of Sports Betting Products: An Economic and Integrity Analysis, highlight that liberal regulation offering consumers access to a wide range of sports betting products and markets onshore, increases consumer channeling rates towards regulated betting operators and, as a result, market oversight.

The rationale for prohibiting markets is often on integrity grounds. However, betting product bans are often not proportionate to the level of risk and based on flawed or unproven data. Banning products onshore does not make a sporting event any less susceptible to betting corruption. In fact, international law enforcement bodies such as Interpol and Europol have stated that unregulated, offshore betting operators are the primary focus for sports-betting related match fixing and fraud.

Responsible licensed sports betting operators – like IBIA’s members – are uniquely motivated and focused on eliminating the opportunity for criminals to profit from sports betting-related match-fixing via regulated betting markets. In addition to their regulatory obligations, our members have a clear commercial need to work with other stakeholders to address sports betting-related match-fixing.

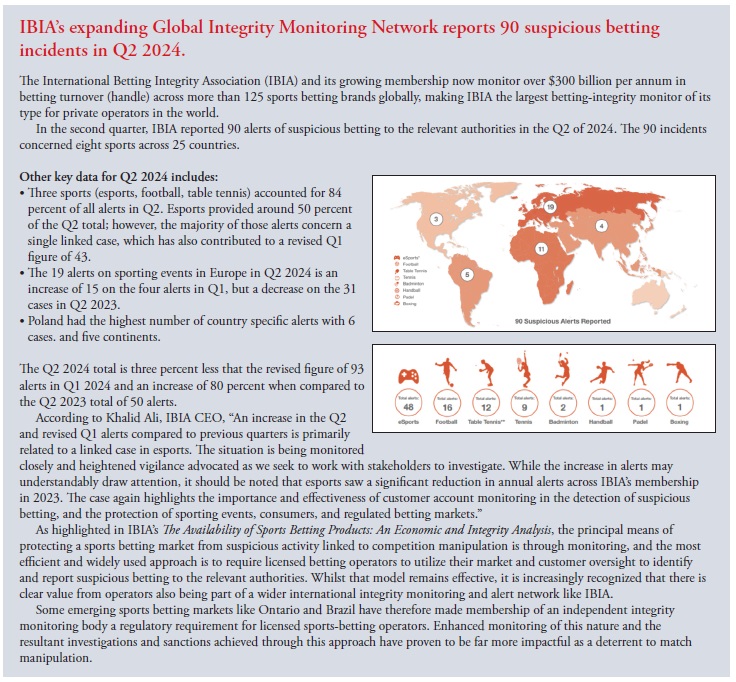

The principal means of protecting a sports betting market from suspicious activity linked to competition manipulation is through monitoring, and the most efficient and widely used approach is to require licensed betting operators to Utilise their market and customer oversight to identify and report suspicious betting to the relevant authorities. Whilst that model remains effective, it is increasingly Recognised that there is clear value from operators also being part of a wider international integrity-monitoring-and-alert network.

For example, IBIA’s international monitoring and alert network is unique in its ability to Analyse account-level data to identify and report suspicious betting activity and potential incidents of match-fixing with a high degree of accuracy to law enforcement, regulators, and sports-governing bodies.

Brazil’s emerging liberal framework

Brazil – a nation that has become increasingly conscious of the adverse impact of match-fixing – will imminently implement a regulatory framework that opens its betting market to responsible, licensed and regulated sports betting operators.

After a long legislative process, the sports betting market was finally Liberalised at the end of 2024. Regulatory ordinances implementing the law have been issued and further regulations are expected during the year before the market begins. At the time of writing, no significant product restrictions are expected to be enforced and current projections assume a liberal market opening in January 2025, resulting in a projected channeling rate of 94 percent in 2025.

The Ministry of Finance’s deadline for guaranteed assessment of an application to be operational in January 2025 closed on August 20, with 114 companies applying. While not all of these applications are expected to be approved, it does demonstrate the attractiveness of the market framework. Indeed, applications are expected to continue to be lodged outside of the guaranteed assessment window in the lead-up to the expected market opening in January 2025.

Enhancing market oversight appears to be a core objective of Brazil’s new regulatory framework, which includes the requirement that operators should join an independent integrity-monitoring body like IBIA. Unlike other jurisdictions that impose that approach on betting operators, the licensing requirement also covers gaming companies in Brazil that have no sports book operation, an anomaly that is highlighted in the Ministry’s Q&A for applicants.

Liberal market conditions and potential growth

Brazil’s regulatory model includes a gross gaming revenue (GGR) tax model and the issuance of an unlimited number of licences, encouraging market competition and innovation.

Although taxes overall are expected to be towards the higher end, that is set against the size and potential of the market. Fundamentally, it is a model that balances the need for state revenue with the desire to create a competitive market environment.

Projected market impact and integrity benefits

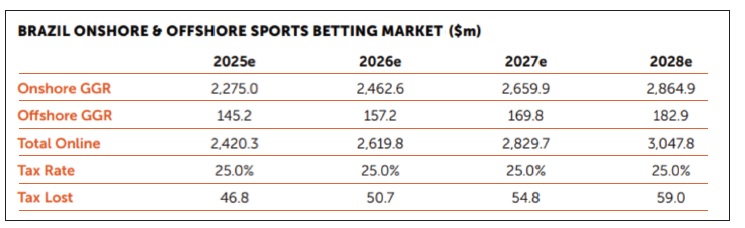

Brazil’s liberal approach to the availability of betting products is projected to significantly enhance channelisation, drawing bettors into a regulated environment that facilitates effective oversight. With expectations of achieving a high onshore channelisation rate, Brazil’s framework is set to Optimise both tax revenue and the integrity of sports betting from a high onshore-market oversight and requirements to be part of an integrity monitoring body.

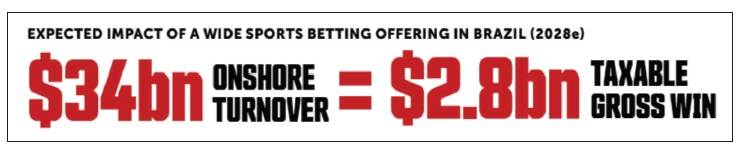

The potential economic impact is substantial, with forecasts suggesting tax returns from $2.3 billion in gross win in 2025, a sports betting turnover of $34 billion and an onshore gross win of $2.8 billion by 2028, making Brazil an attractive market for international and local operators. Brazil is hoping to set a high bar on integrity but there remains a lot of work to do. Our focus must be on creating a robust sports betting integrity ecosystem across the marketplace. A dedicated integrity ordnance, which may have been published by the time this article is released, is expected to address the requirements of operators, sports and other stakeholders in more detail.

Portugal’s restrictive sports-betting environment

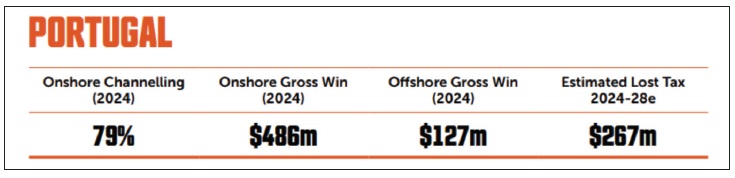

By contrast, Portugal’s approach to sports betting is characterized by high regulatory barriers, including significant restrictions on the types of bets and events operators can offer, along with a high taxation model, and limits on advertising.

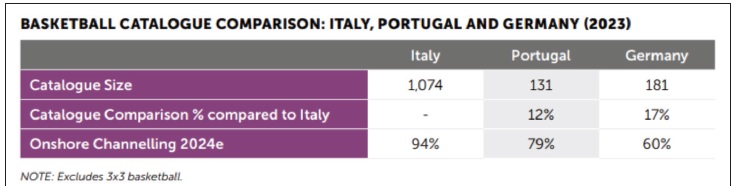

Portugal regulated its sports betting market in 2015 but has a relatively low onshore channelling rate of 79 percent in 2024 as a result of its model. This restrictive environment has profound implications for the market’s growth, attractiveness – operator numbers are relatively low — onshore channelisation and integrity oversight.

An estimated $115 million of sports betting gross win alone went to offshore operators in 2022 and this consumer migration to a more attractive offer is estimated to lead to $267 million in lost tax revenue between 2024 and 2028.