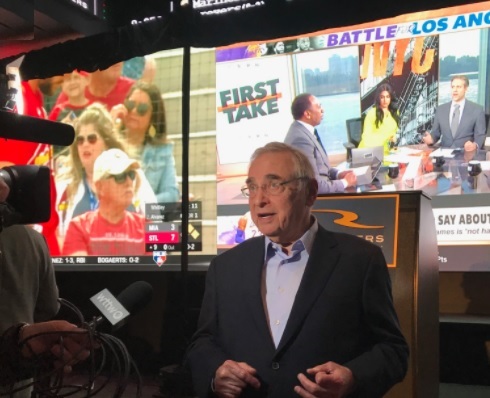

As more states look to legalizing online betting to raise revenue, one Chicago billionaire is already cashing in on the fast growing industry. Real estate magnate Neil Bluhm, who cofounded online casino and sports betting outfit Rush Street Interactive (RSI), got more than $1 billion richer when his firm closed on its merger with the blank check company dMY Technology Group on December 30.

Bluhm, 83, founded RSI in 2012 with his longtime business partner Greg Carlin as an offshoot of his Rush Street Gaming, which owns casinos in Illinois, New York and Pennsylvania. RSI offers sports betting, where customers bet on sports games online, and online gambling, where customers play various casino games such as blackjack and slot machines digitally. RSI recorded a $90 million loss on $178 million sales in the first nine months of 2020, with expected revenues of about $270 million for the year. RSI expects sales to grow to $320 million in 2021. “We’re growing like a weed and we’re adding states all the time,” Bluhm told Forbes in a phone interview. “The growth potential is tremendous.”

He owns a 54% stake in RSI worth $2.3 billion, part of his estimated $6.3 billion net worth, which includes Rush Street Gaming as well as a real estate portfolio spanning from California to Chicago and small stakes in the Chicago Bulls and the Chicago White Sox. Carlin’s 17% stake in RSI is worth about $720 million. The value of RSI has more than doubled since July, when the firm first announced its plans to go public.

RSI went public by merging with a special purpose acquisition company, or SPAC, an investment vehicle with no operations which goes public to raise funds to acquire a privately-owned firm. It’s the latest to join the SPAC boom after RSI’s main competitor, DraftKings, went public via SPAC in April and Texas billionaire Tilman Fertitta’s Golden Nugget Online Gaming completed its own reverse merger on December 30. The DraftKings IPO minted a new billionaire, Israeli entrepreneur Shalom Meckenzie, whose 6% stake in the company is now worth about $1.2 billion.

RSI is currently active in nine U.S. states — Colorado, Illinois, Indiana, Iowa, Michigan, New Jersey, New York and Pennsylvania — and the country of Colombia, while DraftKings operates in 11 states as well as the U.K. and Canada. DraftKings is one of the leaders in the sports betting market, but RSI is a bigger player in the online casino industry. According to Macquarie Group analyst Chad Beynon, RSI controls about 15% of the U.S. online casino market, equal to privately-owned FanDuel and more than DraftKings, MGM and Golden Nugget, which each have 10% market share. In sports betting, FanDuel and DraftKings together have about 60% of the market, with RSI in the low single digits.

“You really have to look out a couple of years and say, ‘what will the market share be for some of these winners in the market?’ Unfortunately this is a time where we’re thinking like software analysts, where we put a multiple on 2025 or 2030 numbers,” said Beynon. “The next question is what does Rush Street do between 2021 and 2030? DraftKings is out there and they have the market access, and Rush Street has done very well in the markets that they’re in.

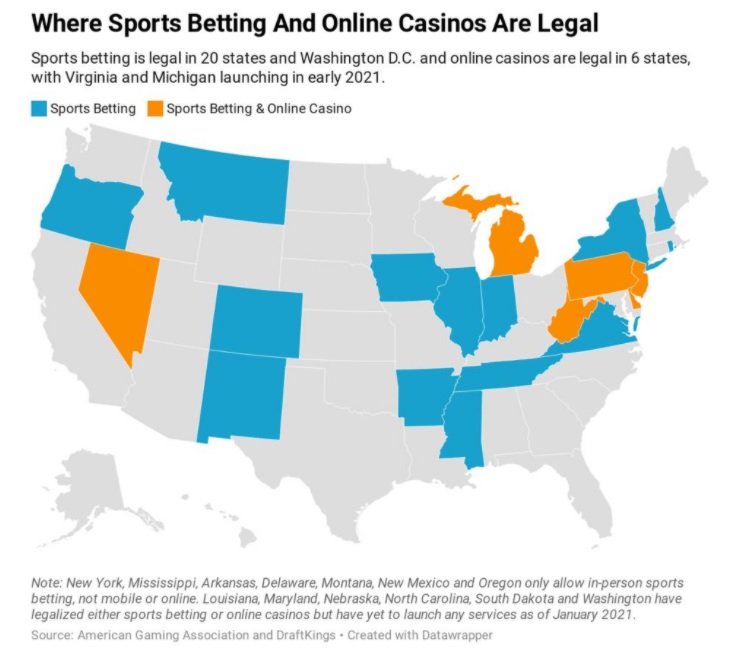

While online sports betting is currently legal in 13 states and Washington D.C. — seven additional states allow only in-person sports betting — the legal market for online casinos is much smaller. As of early January 2021, online casino games are only operating in Delaware, New Jersey, Nevada, Pennsylvania and West Virginia. But the landscape is rapidly changing: Michigan is launching both online casinos and sports betting later this month and Nebraska voters approved the legalization of gambling by a wide margin in November, although the state legislature still needs to enact laws to regulate the industry. Facing a cash crunch from the Covid-19 pandemic, more states could be persuaded to legalize either sports betting or online gambling in the coming years.

“Very few states have allowed [online casinos] so far, but they need revenue now, so many states are considering it. They’re all looking at it because they’re desperate for revenue and jobs,” said Bluhm. “Sports betting is getting all the attention, but we’re projecting that online casinos will be more valuable.”

According to BofA Securities analyst Shaun Kelley, the combined market for sports betting and online gambling is expected to balloon from about $5 billion in annual sales today to $22 billion a decade from now as more states join the map. On January 6, New York Governor Andrew Cuomo announced he would push to legalize mobile and online sports betting in the state, a significant boost for the industry. The next largest states to join could be Florida, where lawmakers have filed a bill to legalize sports betting, and Massachusetts, where a sports betting bill was passed by the state House but is still held up in the Senate.

“We’re in the very early innings of what growth could look like,” said Kelley. “The industry is in such a nascent stage. The big driver of growth is that there’s a whole slew of states and apps that are available that just weren’t there a year ago.”

Forbs Giacomo Tognini