Reproduced from American Gaming Association; Cartogram: Axios Visuals

When the pandemic arrived, the sports betting industry funneled bettors toward the few sports that were actually happening.

What’s happening: Now that sports have returned, the industry has benefited from pent-up demand, while also capitalizing on a busier-than-usual summer, with baseball, soccer, hockey, golf and basketball all in full swing.

By the numbers: The Action Network, a sports betting-focused media company, had its biggest week ever for golf and NHL picks last week, and its second-biggest week ever for the NBA.

Yes, but: Sports betting operators and other businesses were still negatively affected, particularly on the user acquisition front. And with college football prospects dwindling, the fall won’t deliver the betting volume they hoped.

1. The benefits of being young: “For most major stakeholders in the U.S., sports betting was always a 2023 or 2024 story,” says Chris Grove, partner at Eilers & Krejcik Gaming. “So the industry appears to be shrugging off any concern about the long-term impact of COVID-19.”

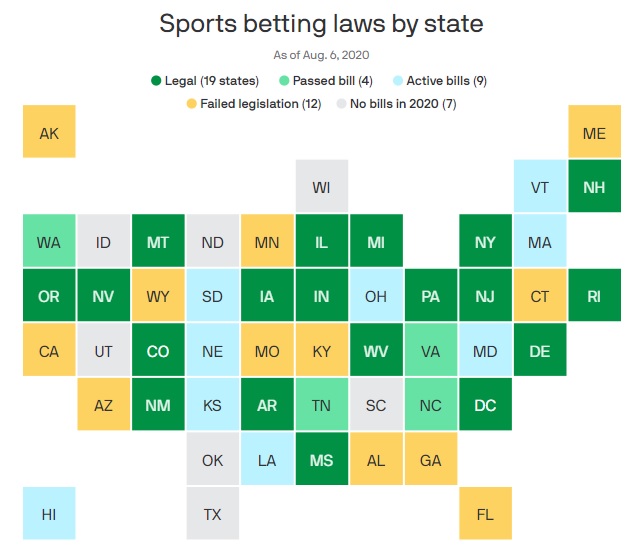

- “You see a lot of operators and startups being able to take this in stride because the story has always been, ‘Here’s where we’re going to be when this is a national market.’ And the U.S. is still years away from that.”

- “That has insulated the industry from the kinds of material impacts you’re seeing in more mature aspects of the U.S. gambling market like casinos and horse racing.”

2. Online betting push: As a result of the coronavirus, some lawmakers and stakeholders who were on the fence about online sports bettingare now more supportive.

- Rhode Island passed a bill last month allowing residents to register for sports betting online instead of having to travel to one of the state’s two casinos to do it in person.

- Movement towards online betting remains slow in some states for political reasons, with casino lobbyists successfully killing bills.

3. All eyes on the NFL: March Madness is the biggest betting event in sports, so losing that this year was brutal. The next big “event” is the NFL season.

Driving the news: Penn National Gaming — which bought a 36% stake in Barstool Sports for $163 million in January — will launch the Barstool Sportsbook app in Pennsylvania next month, just in time for college football.

- This represents the next phase in Barstool’s evolution from media company to sports betting brand, and there’s lots of interest in seeing how it goes.

- “In these crowded state-by-state marketplaces, you need something to cut through, and it’s hard to do that on price, product or brute force marketing,” says Grove. “I think the core bet Penn is making is that Barstool’s brand will cut through.”