The economic and industrial impact of legal sports wagering in the United States. By Victor H. Royer

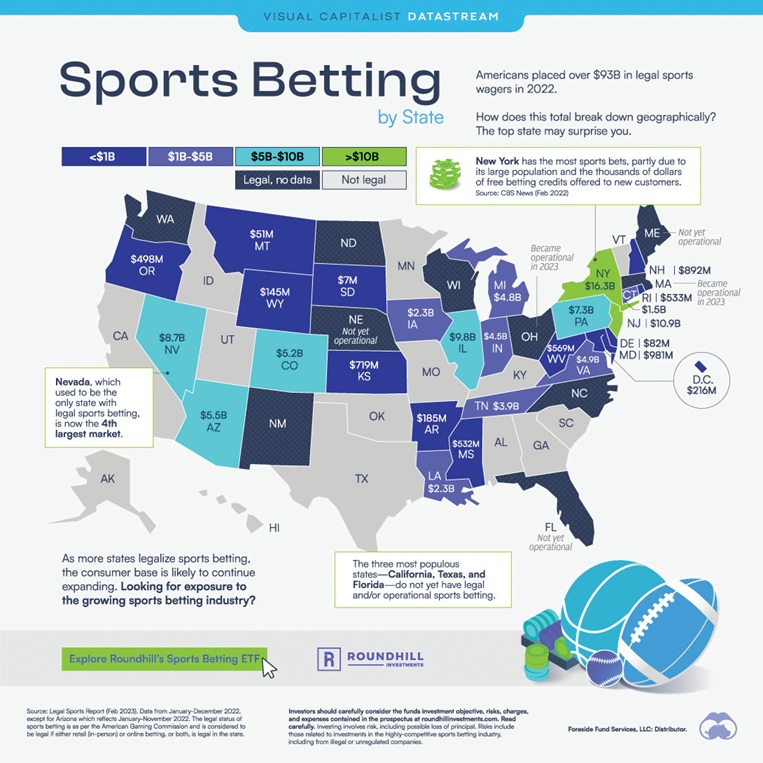

The fiscal impact of legalized sports wagering has exceeded initial projections across multiple jurisdictions. In 2023, legal sports betting operations generated approximately $2.5 billion in tax revenue for states, representing a 35 percent year-over-year increase from 2022 figures.

New York State has established itself as the leading revenue generator, collecting $876 million in sports betting taxes in 2023 alone. This substantial revenue stream has provided states with critical funding for essential services, including education, infrastructure and social programs during a period when many states face significant budgetary challenges.

The taxation model varies considerably by jurisdiction, with effective tax rates ranging from 6.7 percent in Nevada to 51 percent in New York. This variance has created natural experiments in optimal taxation structures, with emerging data suggesting that moderate tax rates between 15 percent and 20 percent may optimize both industry growth and government revenue over the long term.

Key stakeholders should note that the $13 billion in consumer wagering losses that generated this tax revenue represents a market maturation process. Consumer participation has shifted substantially from unregulated to regulated channels, allowing for both taxation and consumer protection.

Economic Development, Employment Growth

The sports wagering industry has emerged as a significant job creator across multiple sectors, supporting an estimated 100,000-plus positions nationwide. Industry expansion has also catalyzed development in adjacent sectors, particularly sports media, data services and technology infrastructure. Companies specializing in geolocation compliance, identity verification and payment processing have experienced substantial growth serving the regulated wagering market.

Regional economic impact studies demonstrate that sports wagering operations generate significant multiplier effects in local economies. This is accomplished through both direct employment and auxiliary spending on services, technology infrastructure, and marketing initiatives.

Enhanced Consumer-Protection Framework

The transition from unregulated to regulated markets represents perhaps the most significant advancement for consumer welfare. These measures stand in stark contrast to unregulated offshore operations and illegal local bookmaking operations, which typically offer no meaningful consumer safeguards. Industry data indicates that regulated channels have captured significant market share from illegal operators, with an estimated 85 percent of sports wagers now placed through legal channels in states where options exist.

This transition has created a substantially safer ecosystem for consumers while simultaneously reducing criminal enterprise activity associated with illegal gambling operations. The transparent regulatory framework also enables more effective monitoring and intervention for potential problem-gambling behaviors.

Strategic Industry Partnerships

These partnerships have created diversified revenue streams for sports organizations while providing wagering operators with valuable content and brand association. The integration of betting content into sports broadcasts has also contributed to increased viewership metrics across multiple sports, with networks reporting five percent to 12 percent viewership increases for telecasts featuring betting-focused content.

Market Expansion and Adoption

The expansion of legal sports wagering across the United States has progressed at an unprecedented pace. Currently, 38 states plus Washington, D.C., and Puerto Rico have authorized sports wagering in some format, creating a regulatory framework that covers approximately 85 percent of the U.S. population.

This regulatory expansion has been accompanied by substantial market growth:

• Annual handle (total amount wagered) exceeded $100 billion in 2023

• Mobile wagering now accounts for over 85 percent of all bets placed in states offering both retail and online options

• Customer-acquisition costs have stabilized after initial market-entry periods

• Multiple operators have achieved profitability in established markets

• Technology and product innovation continue to accelerate

The industry has demonstrated remarkable adaptability to varying regulatory frameworks, with operators successfully navigating state-specific requirements while maintaining core business functionality. This flexibility has enabled continued expansion despite regulatory inconsistencies between jurisdictions.

While the positive impacts of sports wagering legalization are substantial, the industry continues to address several challenges that require ongoing attention and strategic response.

Problem-Gambling Mitigation

With approximately 2.5 million adults affected by problem gambling annually, the industry has implemented comprehensive responsible gambling initiatives:

• Mandatory operator contributions to problem-gambling treatment and education

• Advanced analytics to identify potentially problematic betting patterns

• Technological tools enabling self-limitation and self-exclusion

• Cross-operator coordination on player-protection measures

• Staff training on responsible-gambling-intervention protocols

These measures represent a significant advancement over the unregulated market’s lack of safeguards. Industry best practices now include proactive intervention when problematic behaviors are identified, rather than reactive responses.

Financial-Risk Management

Studies indicating a potential 25 percent to 30 percent increase in household bankruptcy risk associated with online betting access have prompted enhanced financial protection measures:

• Affordability checks for high-volume players

• Deposit and loss-limit functionalities

• Cooling-off periods after significant losses

• Restriction of credit-based funding methods

• Enhanced financial literacy resources

The industry has recognized that sustainable growth depends on responsible participation, with leading operators implementing increasingly sophisticated systems to prevent financial harm.

Regulatory-Standardization Efforts

The current regulatory fragmentation creates operational inefficiencies and compliance challenges. Industry associations are actively working toward greater standardization through:

• Model regulatory frameworks for new jurisdictions

• Cross-border cooperation on compliance requirements

• Technology standards for responsible-gambling tools

• Uniform approaches to data privacy and security

• Standardized self-exclusion protocols

While complete uniformity remains unlikely given states’ rights to determine their regulatory approach, incremental progress toward harmonization continues to improve operational efficiency.

Integrity-Monitoring Systems

To address match-fixing concerns, the industry has developed sophisticated monitoring capabilities, including:

• Real-time odds-movement analysis

• Betting-pattern-anomaly detection

• Cross-operator suspicious-activity reporting

• Information sharing with sports governing bodies

• Advanced statistical modeling to identify potential manipulation

These systems have proven effective at detecting potential integrity issues before they can significantly impact markets, providing a level of protection unavailable in unregulated environments.

Strategic Outlook and Recommendations

Based on current performance metrics and growth patterns, the regulated sports wagering industry is positioned for continued expansion and maturation. Industry stakeholders should consider the following strategic priorities:

- Collaborative Advocacy – Industry operators should coordinate efforts to present unified positions on regulatory frameworks that balance growth opportunities with responsible-gambling protections.

- Technology Investment – Continued innovation in customer verification, responsible-gambling tools and user experience will differentiate successful operators while addressing potential concerns.

- Cross-Sector Partnerships – Deeper integration with sports media, venue operations and entertainment platforms offers significant growth opportunities beyond traditional wagering.

- Data-Driven Responsibility – Leveraging advanced analytics to identify problematic gambling behaviors before they escalate demonstrates the industry’s commitment to sustainable growth.

- Regulatory Engagement – Proactive participation in regulatory development can help ensure that new frameworks are both effective for consumer protection and conducive to business operations.

Conclusion

The regulated sports wagering industry has demonstrated substantial positive impact through tax revenue generation, job creation, consumer protection enhancement and strategic partnerships. While challenges remain, the industry has shown both the willingness and capability to address these issues proactively.

The transition from prohibition to regulation has created a more transparent, accountable and beneficial ecosystem for all stakeholders. As the industry continues to mature, maintaining this balance between commercial opportunity and responsible operation will remain essential to sustaining the substantial economic and social benefits that legal sports wagering provides. By focusing on evidence-based policies, technological innovation and collaborative approaches to industry challenges, stakeholders can ensure that sports wagering continues its trajectory as a significant contributor to state economies while providing a safe, regulated entertainment option for consumers.

*** This exclusive article was originally published in Sports Betting Operator Magazine Issue 016 Volume 7 May 2025***