888 (LSE: 888), one of the world’s leading online betting and gaming companies, announces its audited financial results for the year ended 31 December 2021 (the “Period”).

Financial highlights

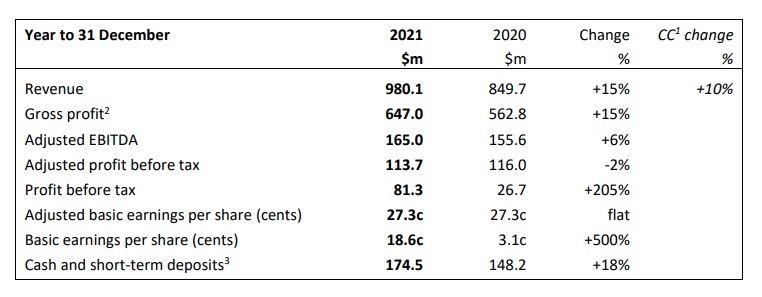

- Group revenue +15% (+10% cc) to a new record of $980.1 million, with double-digit B2C growth in most of our core

and growth markets, driven by competitive advantages in product and content leadership, world class brands and

marketing, and customer excellence - Revenue from regulated and taxed markets represented 74% of Group revenue (2020: 73%), with 17% growth in

revenue from these markets

• Record Adjusted EBITDA of $165.0 million (2020: $155.6 million). Adjusted EBITDA margin ex-US was flat year-overyear, but lower by 1.5 ppts on a reported basis principally reflecting increased investment in the US to support the

launch of SI Sportsbook

• Adjusted basic earnings per share of 27.3c (2020: 27.3c), basic earnings per share of 18.6c (2020: 3.1c)

• Strong cash generation and robust balance sheet, with $174.5 million (2020: $148.2 million) cash and cash

equivalents, excluding customer balances

• No final dividend declared, in light of the potential capital requirements expected as part of the pending William

Hill transaction, with no change to the Group’s dividend policy

Itai Pazner, CEO of 888, commented: “2021 was a very successful year for 888 as we continued to position the Group to become a global leader in online betting and gaming. It was another record year from a financial perspective, and we have truly transformed the scale of the business over the past two years. This step-change in scale has come from a clear market focus on regulated markets, which now make up three quarters of revenue, and where we are seeing really positive market share trends.

We continued to leverage our competitive advantages around product leadership, brands, and customer excellence to improve the quality of products and the customer experience across sports and gaming, all the while maintaining our persistent focus on delivering our safer gambling priorities.

Alongside the strong organic growth and operational progress, 2021 was a busy year for strategic expansion, including nthe long-term strategic partnership with Sports Illustrated and launch of SI Sportsbook, the announcement in September of our proposed acquisition of William Hill, and the sale of our bingo business as we look to increase focus on our core B2C strategy.

Given this strong financial and operational performance, the Board remains confident that, with 888’s advanced technology, products and diversification across markets, the Group is well-positioned to deliver long-term sustainable growth for all its stakeholders into the future

Full report click here