US sports betting & iGaming market spend coming in ahead of our forecasts. 2Q total US sports betting handle came in 25% ahead of our prior estimates and revenue ~42%. 2Q iGaming revenue came in ~45% ahead of our forecast. As we had written in April, 1Q suggested the US sports betting / iGaming market could hit $7B revenue in 2021, and following 2Q data, we are increasing our forecasts for the year from $6B to $7B, with $3.8B from sports betting and $3.2B from iGaming.

The iGaming forecast assumes stay-at-home tailwinds dissipate, but given the early stages of the market, industry growth could more than offset. Our sports betting forecast assumes CT, MD, and SD launch by YE, but only contribute ~$30m of revenue as SD will be purely retail and we expect only retail will be ready in MD before YE. Our longer-term estimates go up slightly (e.g. 2022 $8.5B vs. prior $8.3B, 2025 $16.0B vs. prior $15.6B) as higher spend / capita is offset by a slightly slower legalization path, primarily in iGaming.

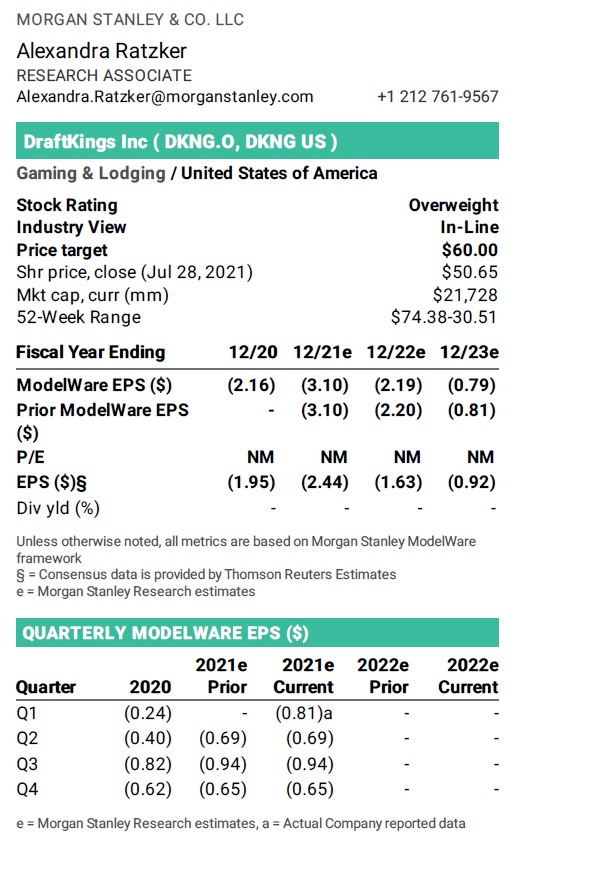

Updating DKNG estimates. We are raising our 2Qe revenue to $281m from $243m (prior implied guidance $221-242m), reflecting higher 2Q21 market revenues ($1.8B vs. prior MSe $1.2B), offset by lower than expected DKNG share (18% vs. prior MSe 20%). Based of the states that have reported, DKNG’s revenue appears to be tracking ~10% below 1Q21 ($312m), partially reflecting seasonality. DKNG appears to have had 6% sports betting hold in 2Q, similar to 1Q and not low on an absolute basis, but low compared to peers (state data suggests Fanduel had ~10% hold and BetMGM 7.25% in the qtr, benefitting from same-game parlays).

As DKNG finishes transitioning its tech stack from Kambi to SBTech by the end of 3Q, we believe this will help DKNG on share. We forecast share recovering back to 20% in 4Q21. This results in $1.25B of 2021 revenue vs. prior $1.14B / guidance $1.05-1.15B and does not include any revenue from new states. Given DKNG raised its FY revenue guidance by $150m the past 2 qtrs on larger qtrly revenue beats, we would expect it to raise guidance by <$150m this qtr, but we see the eventual FY outcome closer to our new estimate. Our EBITDA estimates are largely unchanged ($(130)m / $(623)m in 2Q / ’21 vs. prior $(131)m / $(624)m as we suspect DKNG continues to reinvest in acquiring new customers, but after 2021e EBITDA cuts the past 2 qtrs, we see potential for a more in line outlook this qtr.

Price target to $60 from $58, reiterate OW. Our 2025e EBITDA increases to $1.122B from $1.092B, which drives out price target up to $60 from $58 on an unchanged multiple. The market has soured on DKNG on concerns that 1) it will lose share as the likes of CZR and WYNN market aggressively for the 2021-22 NFL season, 2) it will see greater than expected near-term losses as the market gets more competitive, and 3) it trades at a high valuation.

We are less concerned on these 3 points as on share, we believe that DKNG’s transition to SBTech will help improve its positioning. Fanduel showed in the qtr how strong technology with unique offerings can help drive share as the market matures, with state data suggesting almost 45% sports betting market share vs. 30-35% the prior quarters.

In addition, we see greater risk to BetMGM losing share as CZR and WYNN ramp up marketing as those companies are better positioned for iGaming (where BetMGM has ~35% share vs. DKNG ~17%) than sports betting (where BetMGM has ~10% share vs. DKNG ~20%). On profits, DKNG is now in year 3 in NJ and year 2 in IN and PA. Given a typical 3 year ramp to profitability, we believe it will start giving more examples of driving profits in single states.

On valuation, over the past 3 months DKNG has meaningfully underperformed the S&P 500 (by 20%) and other high growth stocks (by ~10%), despite lower interest rates and stronger revenue, given concerns around share. We see potential for DKNG to re-rate closer to 25x 2025e EBITDA, where some slower growth peers are trading.