Bloomberg 4th January 2021: Gambling company Entain Plc ( formerly known as GVC ) has dismissed an 8.1 billion-pound ($11.1 billion) takeover attempt from MGM Resorts International, saying the bid undervalues the operator that’s benefiting from a boom in online betting.

The latest offer, which would give the Las Vegas casino operator broader access to online sports betting markets, was made public by London-listed Entain in a statement Monday, and tops an earlier all-cash bid made late last year, people familiar with the matter had said.What to know in techGet insights from reporters around the world in the Fully Charged newsletter.EmailBloomberg may send me offers and promotions.Sign UpBy submitting my information, I agree to the Privacy Policy and Terms of Service.

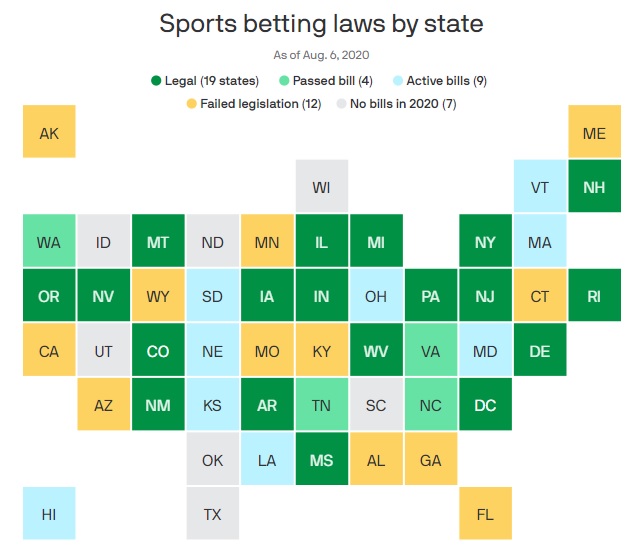

Entain is behind an array of online gambling sites, including Ladbrokes Coral and Bwin, which have become increasingly attractive after the U.S. legalized sports betting in 2018. Las Vegas-based casino giant Caesars Entertainment Inc. is taking over the U.K.’s William Hill Plc, while Flutter Entertainment Plc, headquartered in Dublin, is upping its stake in U.S. bookmaker FanDuel and last year completed a deal for the Stars Group Inc

Under the proposed terms, Entain investors would receive 0.6 of a share of MGM for every share they hold. At 1,383 pence per share, the bid is a 22% premium to Entain’s closing share price on Thursday. The company’s shares jumped 28% to 1,410.50 pence at 9:12 a.m. in London, the biggest intraday gain since 2009.

MGM may also offer a “limited partial cash alternative” to the British company’s shareholders, who would own about 42% of the combined business. A representative for MGM didn’t immediately respond to a request for comment outside of regular business hours.