Gambling.com Group Plc (“Gambling.com Group” or the “Group”) today entered into an agreement with Edison Partners (“Edison”) regarding a $15.5 million investment into the Group. Edison is a growth equity investment firm which manages more than $1.4 billion in assets and is based in New Jersey, the new hub of regulated online gambling in America.

The agreement represents one of the most significant deals between a U.S. private equity fund and a performance marketing company focused on online gambling and sports betting. Gambling.com Group is the fastest growing and one of the most awarded leaders in performance marketing for the global online gambling industry with a particular focus on European markets. The Group expects the U.S. market to grow in size to rival that of the current European one in the coming years.

Charles Gillespie, Chief Executive of Gambling.com Group, says, “We have been thoroughly impressed by Edison Partners’ depth of expertise, breadth of knowledge and professional network. We greatly look forward to bringing on Edison as our teammate in our new American journey. Edison is the right partner at the right time, and I expect our collaboration to deliver powerful results. Their investment in the Group validates our thesis that we are the performance marketing and content platform best positioned to benefit from the expansion of regulated online gambling in the United States.”

The addition of Edison Partners to the Group’s list of investors gives the Group a strategic American growth equity partner who will help advance the Group’s objectives, particularly in its home state of New Jersey and throughout its network in the northeastern United States. As the National Football League officially kicks off, 13 states now take legal sports bets, with at least six more slated to take bets in the coming months.

“We are thrilled to enter the online gaming market with our investment in Gambling.com Group,” said Chris Sugden, Managing Partner at Edison Partners. “The company will continue to monetize the large market opportunity in Europe while increasing investment in the U.S. Online gaming is expanding significantly as regulations are modified on a state-by-state basis.”

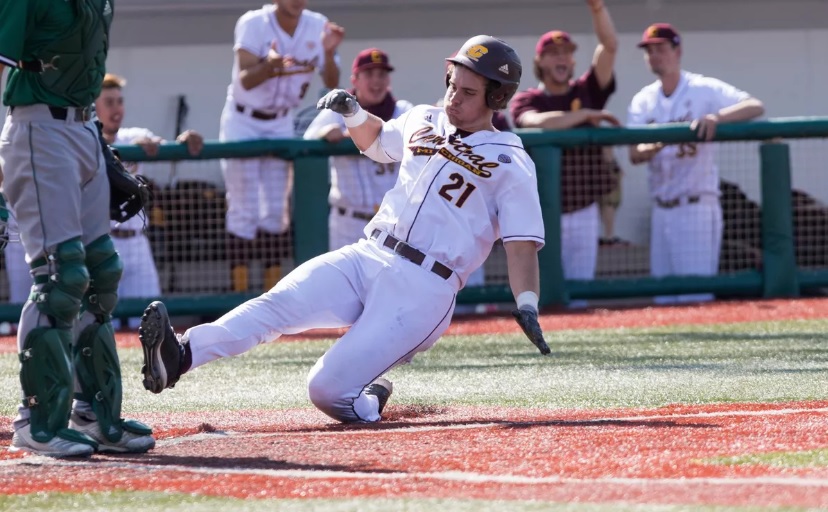

The Group has been executing a comprehensive plan to be the leading performance marketing company within the regulated online gambling sector in the United States since before the invalidation of the Professional and Amateur Sports Protection Act (PASPA) in May 2018. The Group’s flagship website Gambling.com is already active in New Jersey and Pennsylvania, and the Group is investing substantial resources in Bookies.com to make it the pre-eminent source of sports betting information in the United States. The Group has secured licenses to expand business deals with gambling operators in New Jersey, Pennsylvania and West Virginia and has broadened its footprint with key management hires, a new office in Charlotte, North Carolina, and by becoming the first sports betting media group to be accepted as members of the Associated Press Sports Editors (APSE).

“Attention to sports gambling in the U.S. is booming, and we are building out a robust content team, offering products to match that interest,” Gambling.com Group Director of North American Content Gerry Ahern said. “On Bookies.com we are providing a real-time lens for sports fans that educates, entertains and informs them as they explore legal wagering options. On Gambling.com we are keeping the audience up to date with industry news and the latest in legislation as more states come online and more fans are served.”

Proceeds will be used by the Group for general corporate purposes with a view to accelerating certain investments in the United States market.

“With an exceptionally strong brand, robust content creation strategy, player-focused editorial point of view and proven marketing capabilities, Gambling.com Group is well positioned to become the leading provider of new customers to U.S.-based online sportsbook and iGaming operators,” said Gregg Michaelson, Partner at Edison Partners, who will sit on the company’s board of directors after the transaction closes. “Gambling.com Group founder and CEO Charles Gillespie is an industry leading business operator who brings the same ethical and compliant approach to the U.S. gaming market as he has in Europe.”

The investment by Edison in the Group will be satisfied through a combination of new ordinary shares in Gambling.com Group and through a sale of existing ordinary shares in Gambling.com Group by an existing shareholder. The investment will sit in Edison Partners’ latest fund closed in December 2018, their ninth fund with a size of $365 million.

About Gambling.com Group Plc

Gambling.com Group Plc is a multi-award winning provider of digital marketing services for the global iGaming industry. Founded in 2006, the group has a workforce of more than 110 and operates from offices in Dublin, Charlotte, Tampa and Malta. The group publishes websites that offer comparisons and reviews of online gambling websites across 15 national markets in nine languages. Players use these resources to select which online gambling operators they should trust to offer a safe and honest online gambling experience. The Group’s publishing assets include the leading iGaming industry portal, Gambling.com as well as Bookies.com and the CasinoSource series of portals, among many others.

About Edison Partners

For more than 30 years, Edison Partners has been helping CEOs and their executive teams grow and scale successful companies. The firm’s investment team brings extensive investing and operating experience to each investment. Through a unique combination of growth capital and the Edison Edge platform, consisting of operating centers of excellence, the Edison Director Network, and executive education programs, Edison employs a truly integrated approach to accelerating growth and creating value for businesses. A team of experts in financial technology, healthcare IT and enterprise solution sectors, Edison targets high-growth companies with USD $5 million to $25 million in revenue; investments also include buyouts, recapitalizations, spinouts and secondary stock purchases. Edison’s active portfolio has created aggregated market value exceeding USD $10 billion. Edison Partners is based in Princeton, N.J. and manages more than USD $1.4 billion in assets throughout the eastern United States.