Of the Group’s gross winnings revenue in the second quarter, 59% came from locally licensed markets, which represented 41% growth year-on-year. Other items affecting the quarter were the planned investments in the USA, both in marketing and operating expenses.

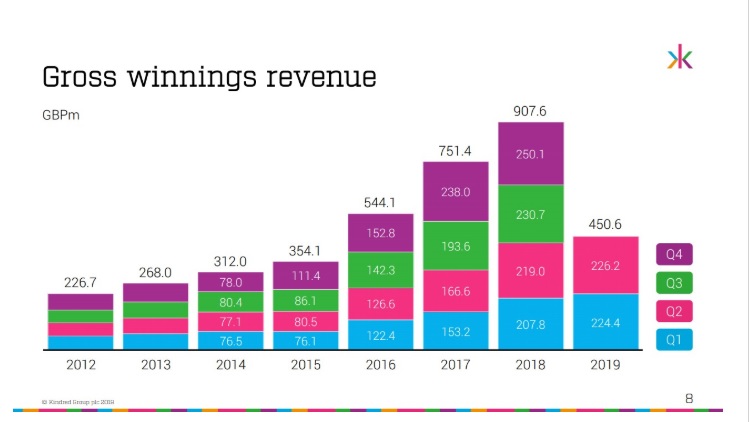

Kndred Group presented its Interim report for January to June 2019. Gross winnings revenue amounted to GBP 226.2 million for the second quarter of 2019 from 219.0 million in the same period of the prior year, an increase of 3 percent; and GBP 450.6 (426.8) million for the first half of 2019, up just over 5 percent. Underlying EBITDA for the second quarter was GBP 30.5 million, down by nearly 35% from 41.7 million of the same period last year, and it marked GBP 61.1 (89.2) million for the first half of the year.

For the second quarter of 2019, profit after tax amounted to GBP 12.5 (25.5) million, and earnings per share fell to GBP 0.055 from 0.112 of the same period of the prior year. In the first half of the year, profit after tax was GBP 27.6 (55.4) million, and earnings per share marked GBP 0.122 (0.244). Number of active customers during the second quarter was 1,478,437, down from 1,550,508 year-on-year.

According to Kindred Group CEO Henrik Tjärnström, who hosted a presentation today at Kindred’s office in Stockholm, locally licensed revenue growth of 41 percent year on year but tough EBITDA comparatives are due to the 2018 World Cup and Swedish re-regulation.

“Despite very tough 2018 comparatives, which included the start of the World Cup, revenues grew 4 percent in constant currency year on year with particularly strong growth in locally licensed markets. Of the Group’s gross winnings revenue, 59 percent came from locally licensed markets which represented 41 percent growth compared to the same quarter last year (growth of 19 percent excluding Sweden). This focus on growth in locally licensed markets is very much part of our strategy and, as expected, has resulted in margin pressure from higher betting duties. During the second quarter of 2019, gross winnings revenue from mobile grew by 11 percent compared to the second quarter of last year and amounted to 77 percent of our total Gross winnings revenue,” he stated.

Tjärnström also explained that the new licensing regulation in Sweden has resulted in significant short-term margin pressure driven by higher betting duties but also higher marketing as the company is investing for the longer term. In the Swedish market, Kindred saw a significant improvement quarter-on-quarter, but EBITDA contribution was still down GBP 9.2 million when compared to the second quarter last year.

Total marketing for the Group, as a percentage of gross winnings revenue, came in at 29 percent and was at its highest level since 2013 when compared to other second quarters in non-major football tournament years. Kindred’s CEO said the company also continues to invest heavily in technology and other operating expenditure in order to drive its future growth: “Whilst this may reduce profitability in the short term, we are confident that, as we have previously proven, this will drive future growth in gross winnings revenue and profits, particularly in locally licensed markets. Other significant items affecting the quarter were the planned investments in the USA, both in marketing and operating expenses, that contributed GBP 1.6 million of negative EBITDA in the quarter.”